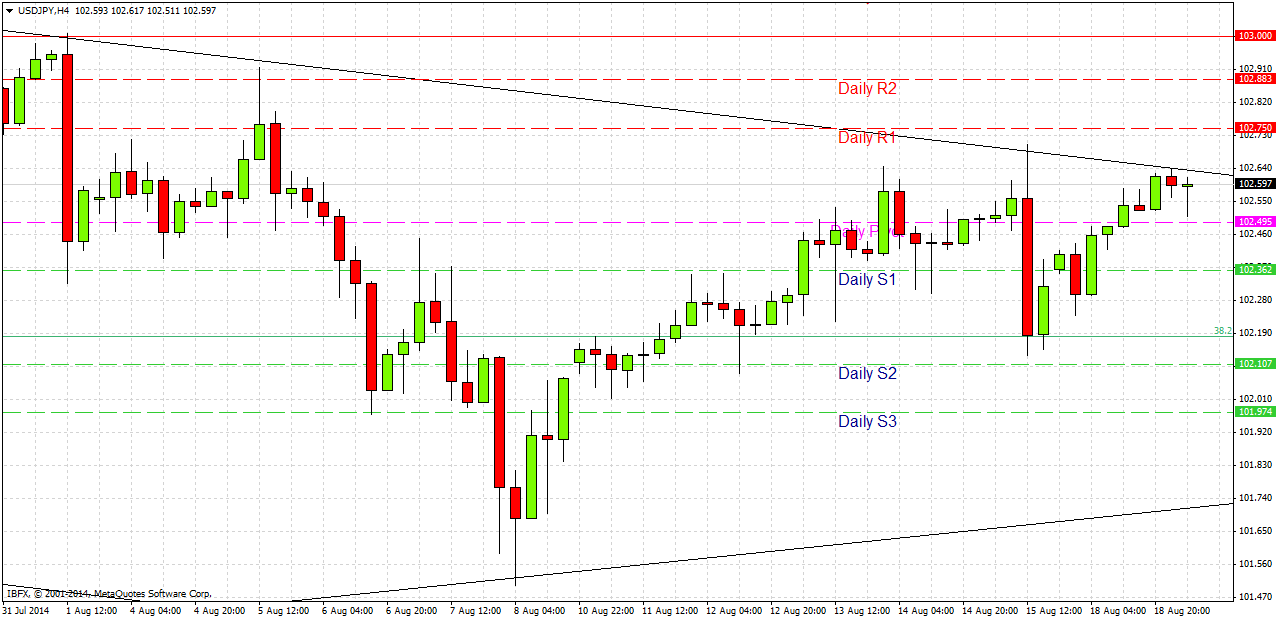

USD/JPY Signal Update

Yesterday’s signal was not triggered as the price never reached 103.00.

Today’s USD/JPY Signal

Entries should only be made before 5pm New York time, or during the following Tokyo session.

Risk 0.75% of equity.

Short Trade

Short entry following bearish price action on the H1 time frame after the first touch of 103.00.

Place a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the price reaches 102.66.

Remove 50% of the position as profit at 102.66 and leave the remainder of the position to run.

USD/JPY Analysis

We are still within the consolidating triangle that I wrote about yesterday. We tested the upper trend line during the Tokyo session and got a small bounce off it. However the trend is bullish and we are again very close to this trend line at the time of writing.

Nothing has really changed since yesterday. A break of this trend line should see a rise to the 103.00 which we are unlikely to exceed before the FOMC minutes are released tomorrow. If the trend line holds, we have local support below at the 38.2% Fibonacci retracement level of the long-term upwards move, at 102.19, but I would not recommend any long trades off that point.

There are no high-impact data releases due today concerning the JPY. Regarding the USD, there will be data releases at 1:30pm London time concerning CPI and Building Permits. Therefore it is likely to be a quiet today until the New York session begins.