USD/JPY Signal Update

Yesterday’s signal was not triggered as although the price did reach 103.00, there was no bearish price action at this level.

Today’s USD/JPY Signal

Entries should only be made between 8pm and 8am London time.

Risk 0.75% of equity.

Short Trade

Go short following bearish price action on the H1 time frame after the first touch of 104.00.

Put a stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 103.50.

Take off 50% of the position as profit at 103.50 and leave the remainder of the position to ride.

Long Trade

Go long following bullish price action on the H1 time frame after the first touch of the broken triangle trend line currently at about 102.50 - 102.60.

Put a stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 103.00.

Take off 50% of the position as profit at 103.00 and leave the remainder of the position to ride.

USD/JPY Analysis

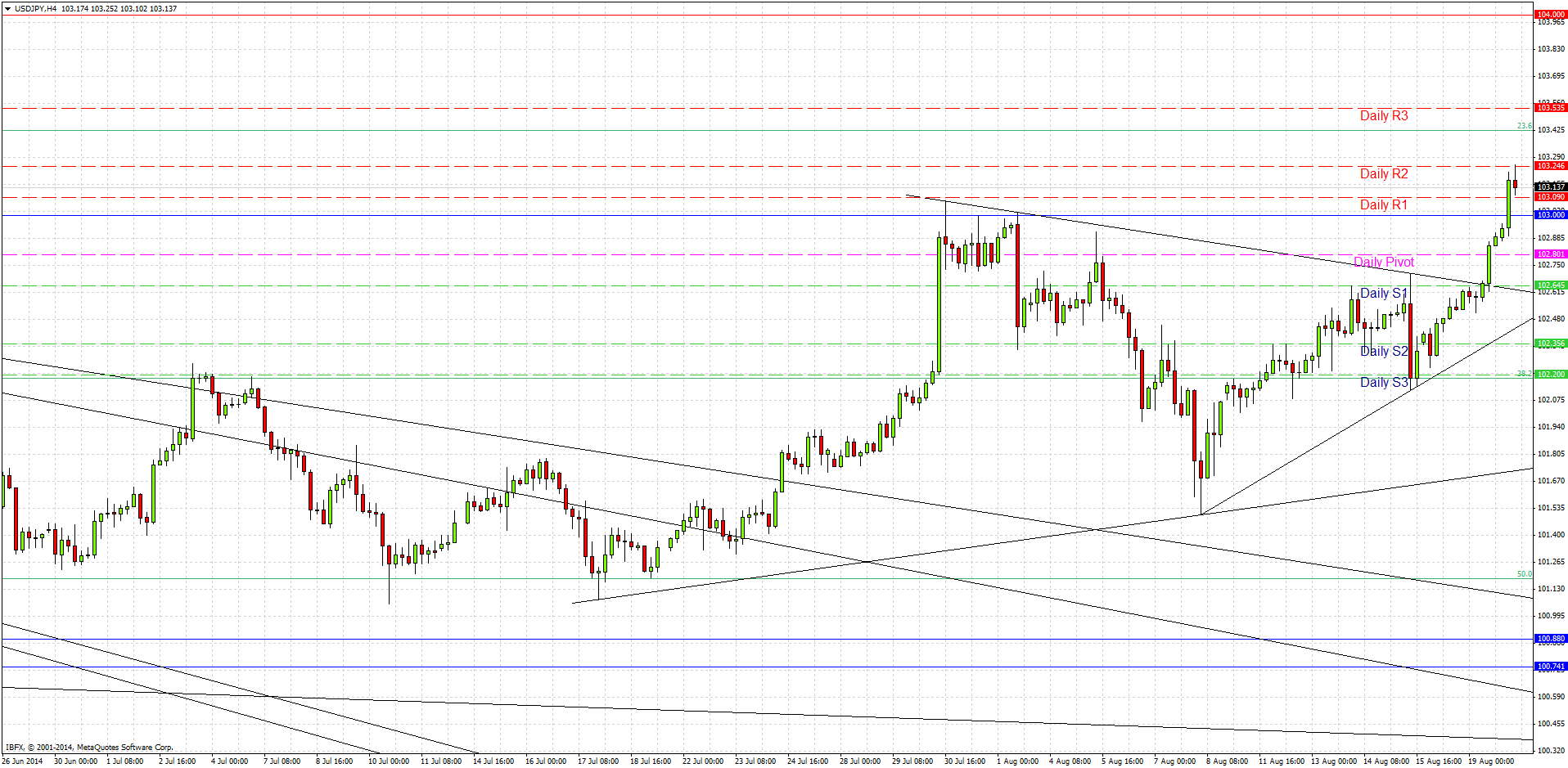

Yesterday I forecast that a break out from the triangle would see a rise to 103.00 at least. This happened and the price actually reached 103.25 a short while ago. The trend is bullish with USD strength across the board.

We have possible resistance at the 23.6% Fibonacci level at about 103.43, followed by the round number at 104.00.

Pull backs to the broken triangle trend line, and to a lesser extent the broken resistance at 103.00, could be good long opportunities.

However there will quite probably be little action until the news release after London closes tonight.

There are no high-impact data releases due today concerning the JPY. At 7pm London time, there will be a release of the FOMC Meeting Minutes, which is likely to affect this pair. Therefore it will probably be a quiet today until that time.