USD/JPY Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/JPY Signal

Entries only before 8am London time tomorrow (Friday).

Risk 0.75% of equity.

Short Trade

Short entry following bearish price action on the H1 time frame after the first touch of 104.00.

Place a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the price reaches 103.50.

Remove 50% of the position as profit at 103.50 and leave the remainder of the position to run.

Long Trade

Long entry following bullish price action on the H1 time frame after the first touch of 103.00.

Place a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price reaches 103.40.

Take off 50% of the position as profit at 103.40 and leave the remainder of the position to ride.

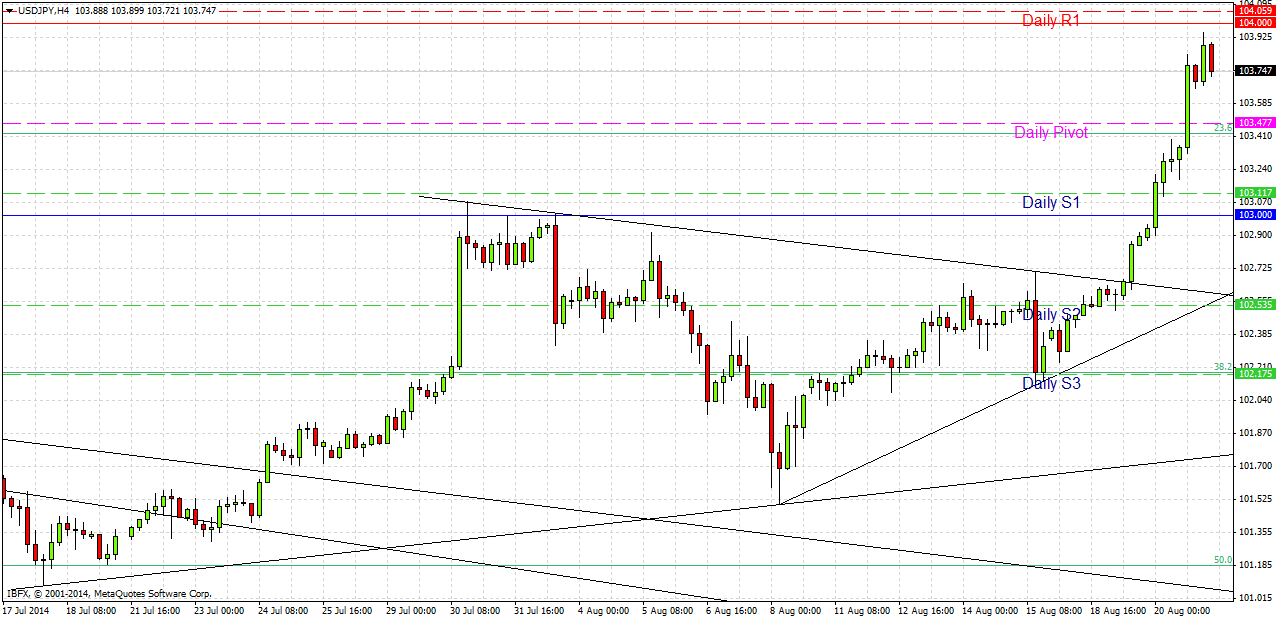

USD/JPY Analysis

The strong USD bullishness has continued across the board, and was so strong against the JPY that this pair just kept going straight up, offering no opportunity to enter on safer pullbacks. We have just made a high very close to the key resistance level of 104.00. Technically, it is quite likely that we will start to fall from this level, at least temporarily. We have not really managed to breach this level all year so there will be some profit-taking here.

The USD is also close to key resistance levels against most of its other major pairs. Therefore in the absence of further strongly bullish USD news, there should be a good short opportunity if we can get back close to 104.00, provided it is confirmed by bearish price action.

There is likely to be support at 103.40 and again at 103.00.

There are high-impact data releases due today concerning only the USD, but nothing regarding the JPY. At 1:30pm London time there will be U.S. Unemployment Claims data, followed by the Philly Fed Manufacturing Index at 3pm, both of which are likely to affect the USD. Therefore today this pair is likely to be relatively quiet before the New York session, although it may sell off rapidly from 104.00.