USD/JPY Signal Update

Last Thursday’s signals were not triggered and expired.

Today’s USD/JPY Signal

Entries must be made before 8am London time tomorrow (Wednesday).

Risk 0.75% of equity.

Short Trade

Go short following bearish price action on the H1 time frame after the first touch of 105.00.

Put a stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 104.25.

Remove 75% of the position as profit at 104.25 and leave the remainder of the position to ride.

Long Trade 1

Go long following bullish price action on the H1 time frame after the first touch of 103.00.

Put a stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 103.40.

Remove 50% of the position as profit at 103.40 and leave the remainder of the position to ride.

Long Trade 2

Go long following a strong higher low high after the price falls below 103.50.

Place a stop loss 1 pip below the local swing low.

Take off 75% of the position when profit is twice risk and leave the remainder to run.

USD/JPY Analysis

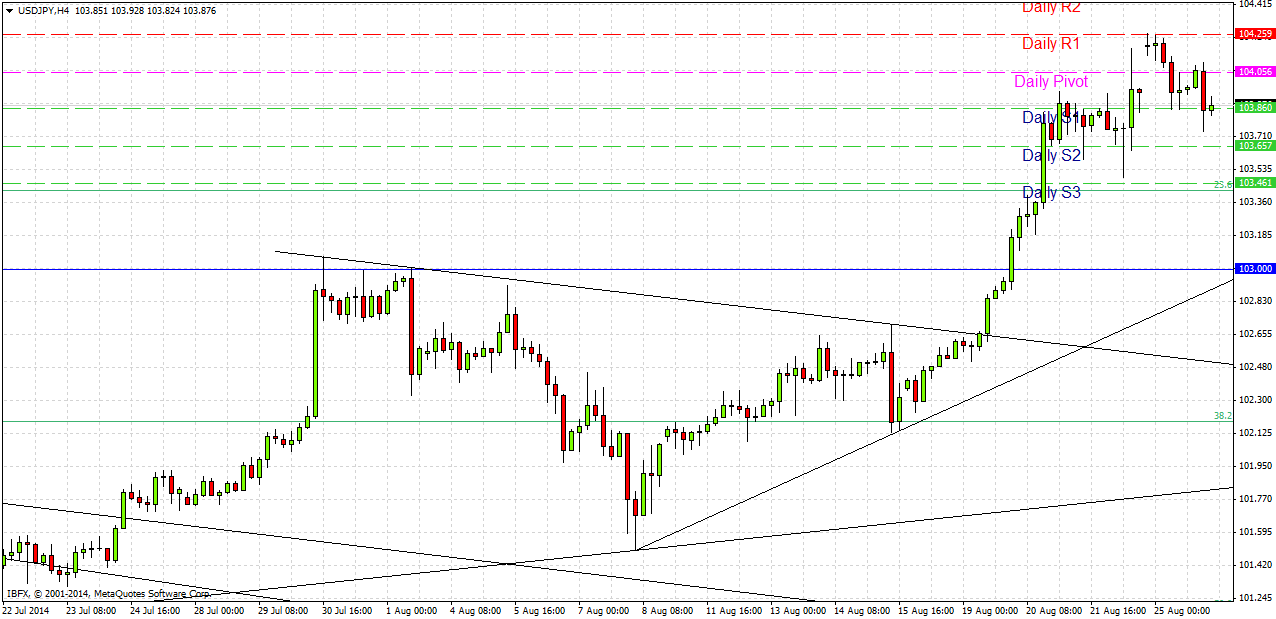

I was correct in saying last Thursday that the level at 104.00 was going to prove to be at least a temporary barrier. The price was however finally able to push through it on Friday when the Chair of the Federal Reserve started speaking. Although we gapped up a little beyond 104.00 over the weekend, we are back at around that level, and it has probably lost its significance for now.

There is key support below at 103.00, but in any case as the USD has been so strong, and the JPY so weak, there should be a good long opportunity if we pull back today to below 103.50, which has some confluence with the round .50 and also a Fibonacci Retracement level of 23.6% from the major upwards move over the past year or so.

The next key resistance will be the key psychological number of 105.00 close to a 6-year high.

My colleague Christopher Lewis is extremely bullish on this pair, expecting it to rise all the way to 110.00.

There are no high-impact data releases due today concerning the JPY. Regarding the USD, at 1:30pm London time there will be a release of Core Durable Goods data, followed by CB Consumer Confidence at 3pm, both of which are likely to affect the USD. This pair is likely to be most active during the New York session.