USD/JPY Signal Update

Yesterday’s signals were not hit, so they expired without being triggered.

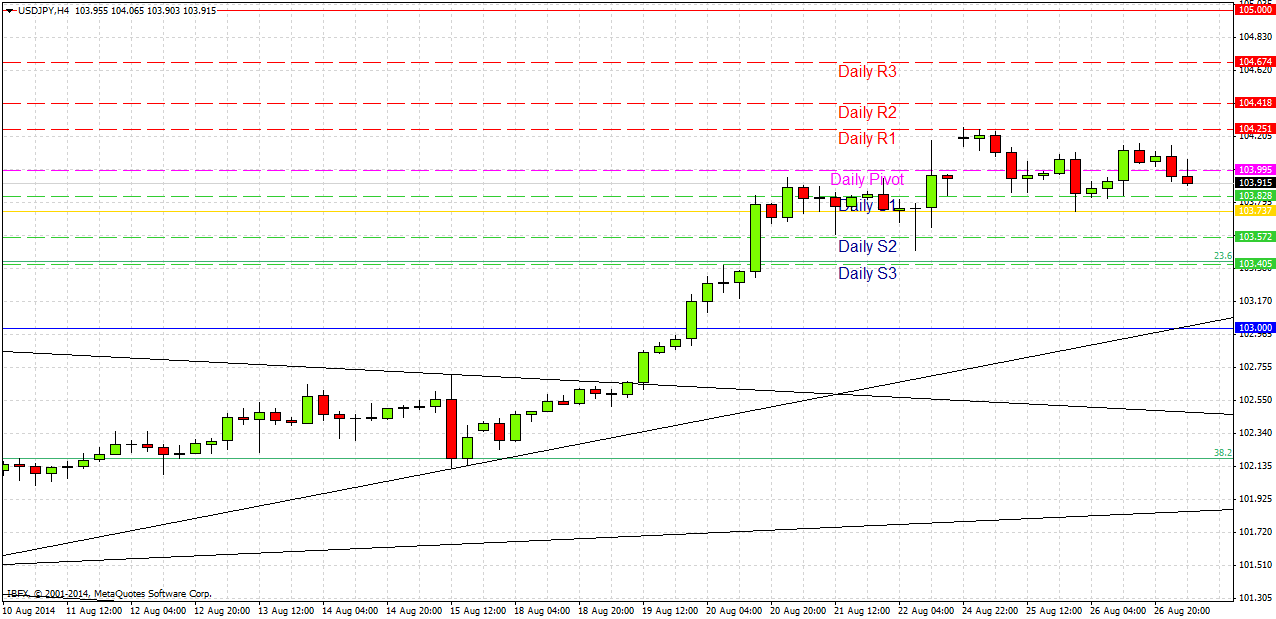

Today’s USD/JPY Signal

Entries may only be taken before 8am London time tomorrow (Thursday).

Risk 0.75% of equity.

Short Trade

Short entry following bearish price action on the H1 time frame after the first touch of 105.00.

Place a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the price reaches 104.25.

Take off 75% of the position as profit at 104.25 and leave the remainder of the position to run.

Long Trade 1

Long entry following bullish price action on the H1 time frame after the first touch of 103.00.

Place a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price reaches 103.40.

Take off 50% of the position as profit at 103.40 and leave the remainder of the position to run.

Long Trade 2

Long entry following a strong higher low high after the price falls below 103.74.

Place a stop loss 1 pip below the local swing low.

Take off 75% of the position when profit is twice risk and leave the remainder to run.

USD/JPY Analysis

We did dip yesterday before rising back up to around the 104.10 area, from which we have now fallen again. The daily candle ended as a bullish pin bar, but its location in the broader picture means this is not very significant.

It is still worth having a bullish bias as there is no very clear resistance before the 105.00 level above us, and this pair more than any other moved strongly last week.

Today will probably be a very quiet day, but there is a chance for more long trades below 103.74, possibly around 103.50 as I identified yesterday, or even lower at 103.00. I suspect we will not really be able to break below 103.50 today in any event.

There are no high-impact data releases due today concerning either the JPY or the USD, so it likely to be a quiet day.