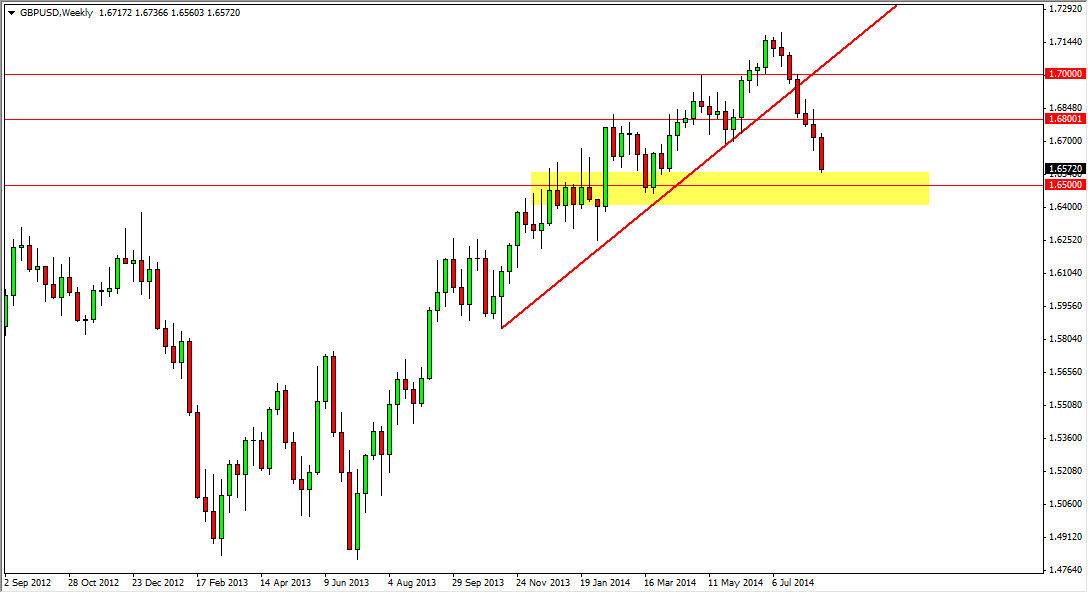

GBP/USD

The GBP/USD pair fell hard during the course of the week, as we continue to see bearishness in the British pound in general. I believe that this market will continue to go a little bit lower this week, but as you can see on the chart I have a yellow rectangle drawn on top of the 1.65 handle. That area and my opinion is going to be supportive, so I think getting below there will be a little bit of a challenge. Although I am very bullish on the US dollar, I think this is a pair that might be best left alone at the moment.

EUR/USD

The EUR/USD pair fell again during the course of the week, and more significantly broke down below the 1.33 handle. We broke down below the bottom of three hammers in a row, so on this chart we see nothing but negativity, and as a result I am a seller of the Euro in general. Quite frankly, I think that the market will drop to the 1.30 level, and then to the 1.28 level which I have highlighted by the yellow rectangle. I think rallies will continue to be selling opportunities.

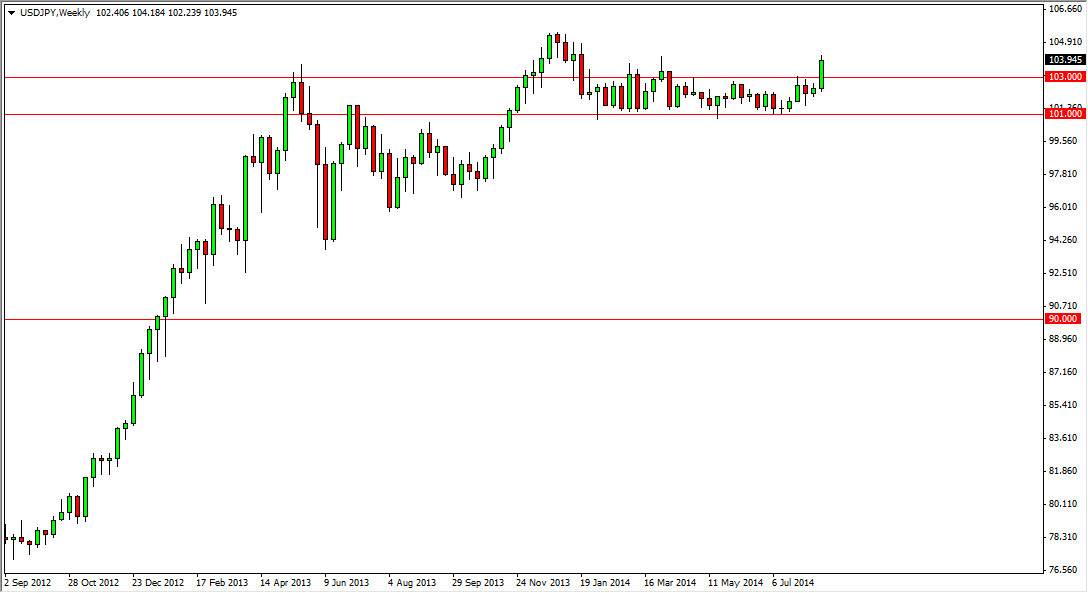

USD/JPY

The USD/JPY pair broke out during the week, closing just underneath the 104 level. That’s an area that is slightly resistive, but the fact that we get above the 103 level tells me that the market is in fact trying to grind its way higher. The 105 level above will be somewhat resistive, but ultimately I think this market is moving to the 110 level, so buying on the dips will be the way to go as the US dollar continues to strengthen overall. By the end of year, I think this pair will probably be closer to the 110 handle.

USD/CAD

The USD/CAD pair rose during the course of the week, but as you can see for the third week in a row we found far too much resistance of the 1.10 level. I think ultimately we will get above there though, so that’s why I have the yellow rectangle drawn on the chart. If we don’t get the breakout above there during this week, we could very well see the market pullback to the trend line, which I fully anticipate will hold as well. Either way, I am bullish of the US dollar in general but those are the two areas I am looking for bullish action in order to start buying the US dollar, and selling the Canadian dollar.