The AUD/USD pair has been range bound for some time now, and the Friday session did little to change that. The Non-Farm Payroll numbers out of America were a bit light in comparison to the expected numbers, but at the end of the day it wasn’t enough to kill off the US dollar. The market essentially shrugged off the bad news in most markets, and as a result the greenback is still the preferred currency to own overall, although the Aussie did in fact gain during the session.

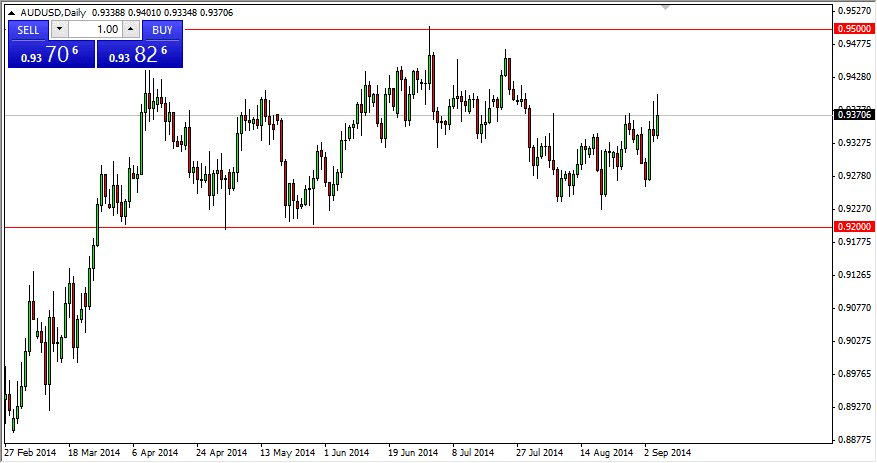

You can see that we broke above the top of the shooting star from Thursday, normally a very strong sign. However, there isn’t a lot of room to the upside on the chart as I think that perhaps 0.9450 has become a bit of a ceiling at this point in time. Certainly the 0.95 level is, and as a result I think that this is the kind of market that you will find conducive to trading short-term binary options, or at least smaller positions, and playing the back-and-forth range until we finally get some kind of breakout or breakdown.

Gold markets aren’t helping the Aussie.

The gold markets look like they are getting close to falling apart, and this of course is a main driver of Aussie strength or weakness. Because of this, I think that the AUD/USD pair will eventually fall apart, but it could take some time. In the meantime, the only thing you can do is assume that the range continues. This leads to excellent trading opportunities, but only of the short-term variety. You literally could find yourself alternating between long and short positions in this pair on a daily basis at this point in time.

The first question that a new trader will always ask me after hearing something like that is “What happens when the market moves out of the range, won’t I lose at that point?” The answer of course is yes. But the idea is that you should have quite a bit of winnings at that point in time. If I told you that you could win 5 times and lose once, would you take that trade?