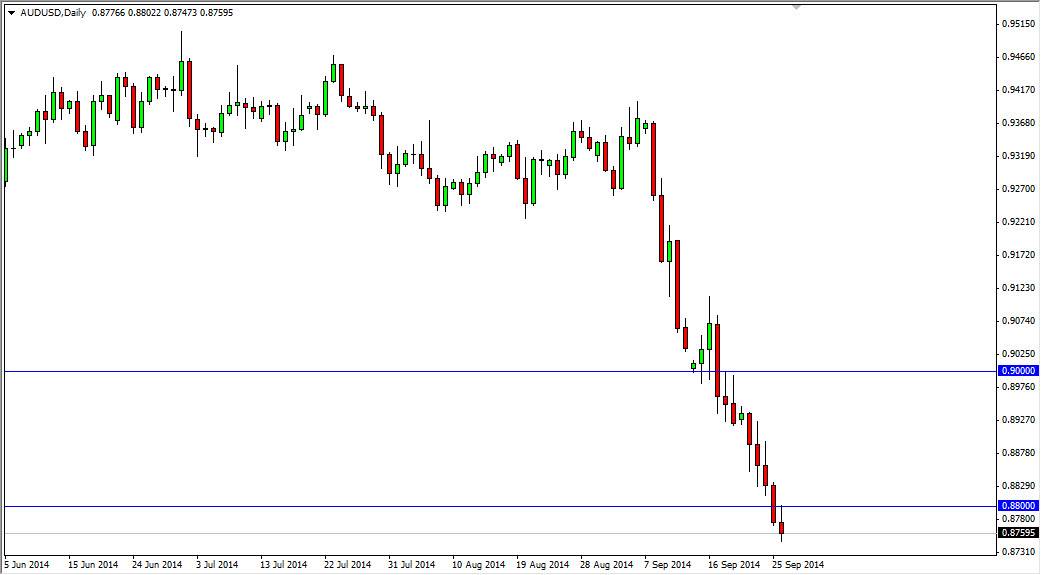

The AUD/USD pair initially broke higher during the course of the day on Friday, but ran into the 0.88 level and pullback. That area was once a supportive level and as a result it makes sense that the market would find it to be resistance. With that, we ended up forming a shooting star, which of course is a very negative sign. A break below the bottom of the shooting star should send this market down to the 0.85 level which is the next large, round, psychologically significant number. After all, the market seems to be broken and with the usual correlation of gold markets dragging on the value the Australian dollar, it’s not a big surprise that we would continue lower.

The Aussie dollar looks rather anemic at this point in time, and I believe that not only the 0.88 level is going to be resistive, but the 0.90 level will be as well. It’s going to take a significant amount of momentum to break out to the upside and get above that level.

The shape of the candle tells the story.

Shape of this candle of course tells a story. In other words, the fact that we could not keep any of the gains during the session tells me that the market is going to continue going lower. It doesn’t even matter at this point time whether we bounce or not, I think it just offers a nice selling opportunity. If we could get above the 0.90 level, for me that signifies that enough momentum has been build up in order for us to break out to the upside, and that of course is a very positive sign.

I believe that the Australian dollar is probably going as low as 0.80 given enough time, but that’s a longer-term call. With that, I think that commodity markets and commodity currencies in general are going to have a hard time going forward, and as a result the US dollar should continue to remain the favored currency worldwide. That being the case, I have no plans to go long.