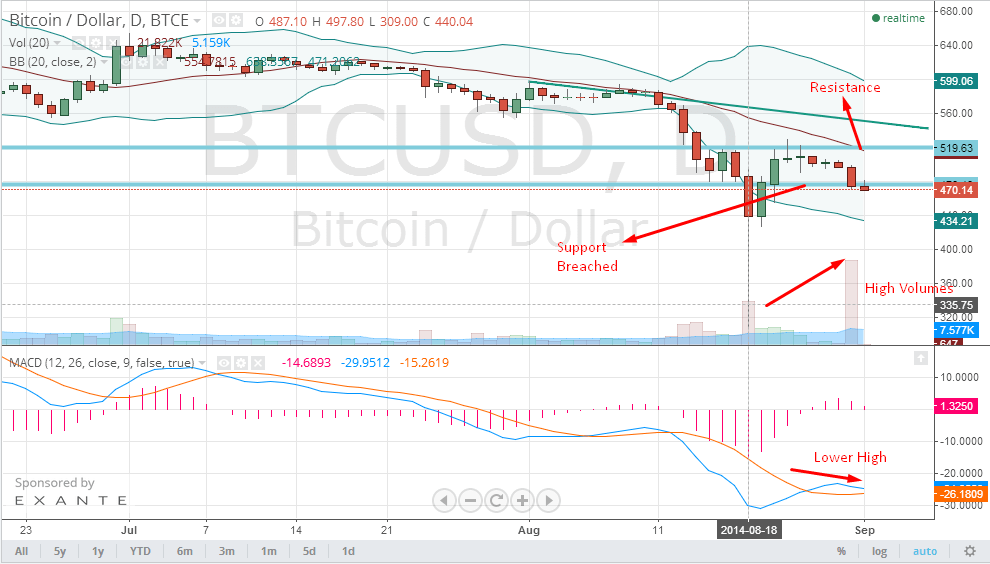

BTC/USD on the daily charts was unable to find buying support above the levels of $521 and slid back below the all important psychological support at $500. The breach of all important support on the back of above average volumes is a cause of concern and makes traders believe that the momentum is clearly in the hands of bears. The resistance for BTC/USD comes in at $525 on the upper end and only a close above that particular level would make traders comfortable before taking fresh long position. The momentum indicators for the BTC/USD have given a fresh sell signal indicative of the strong negative bias.

Actionable Insight

Short BTC/USD at current levels for a intermediate target at $400 with a stop loss at $511.

Long BTC/USD only if it closes above $525 for a target at $557 with a stop loss below $500.

One of the most prominent supporters of Bitcoin, Charles Shrem, has revealed his plans that he will plead guilty for his link with the online black marketplace Silk Road, a place for narcotics and drug paraphernalia. Shrem was slapped with the federal charges in January that he helped the Silk Road users to convert their money into bitcoins to enable them trade into illegal drugs. Preet Bharara, the United States attorney in Manhattan, who will overlook the proceedings had stressed earlier that the authorities will take the matters of usage of alternative forms of currency for illegal purposes seriously.

In the meanwhile, as the New York's BitLicense is up for an extended comment period, there are high hopes that the state will modify and incorporate the bill as per the expectations of the Bitcoin community. While Ben Lawsky, the superintendent of the New York Department of Financial Services (NYDFS) has stated that the bill once approved could be a reference point for other states to float Bitcoin rules, it is also expected that the other states could learn from the gaps of the New York bill and would be induced to bring rules that are more convincing to the Bitcoin supporters. Presently, Texas, New Mexico, New Hampshire, California and Colorado are viewed as potential states to come out with their own Bitcoin regulations.

The previous day was another day of fall for Bitcoin marked by an unusual trading activity. It was identified that one trading bot behaved abnormally, leading to increase in trading volume of bitcoin to over 28,000 against its normal trade volume of 3000. However, the bitcoin prices had started diminishing before the unusual trading activity occurred pointing little correspondence to the Bitcoin fall.