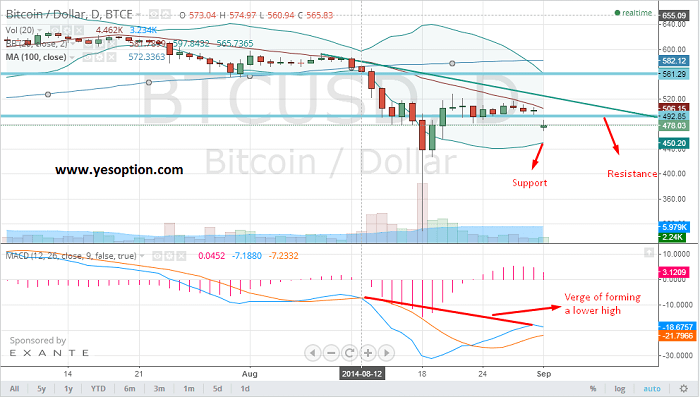

BTC/USD on the daily charts is currently trading lower with dismal volumes to say the least. The digital currency opened gap down and traded mostly near the lower end of the trading range. The resistance for the BTC/USD comes near the $492 level and the next zone of support is near $450. The momentum indicator for the BTC/USD is on the verge of giving a fresh sell signal and in doing so would form a lower high which is a bearish indicator indicative of the absence of buying support at the current moment. It is important to note that the BTC/USD is currently trading below the all important daily moving averages which is a bearish sign.

Actionable Insight:

Short BTC/USD at current levels with a intermediate target at $420 with a stop loss at $492

Wagepoint, a Canada based payroll firm that first offered cryptocurrency payment option in place of salaries is stunned with the overwhelming response they received. Wagepoint had started the service last November, more as a side project and had least expected takers for their offering. However, the firm's CEO, Shrad Roa said that employees from as many as 10 firms have registered for the bitcoin payment option while many are quickly joining the bandwagon. Rao pointed out that contrary to their expectations; many of the customers are taking Wagepoint's services just because of its Bitcoin integration.

The gaining Bitcoin traction had brought good news for the gamers and geeks as their favourite online streaming platform, Twitch.tv is all set to start accepting bitcoins. Many consider the Twitch's step as strategic, as by accepting bitcoins the company could well be positioned to bank upon its young and techie audience. Twitch alone moves 2% of the U.S. traffic and its fame in the online gaming arena could be understood from its record of 55 million unique visitors this July. Thus, by accepting Bitcoin payments Twitch is eyeing more users from regions where conventional payments like credit card are still not beingused extensively.

Finally, Singapore could too boast of its new CRXzone exchange, which would offer both Bitcoin and litecoin trading for the residents. The set up of the exchange is meant to attract a larger international customer base through dynamic funding and withdrawal options. The company's CEO Pawan Kumar is confident that the Bitcoin has power to replace all other digital currencies and is more likely to be a long-term player in the digital world.