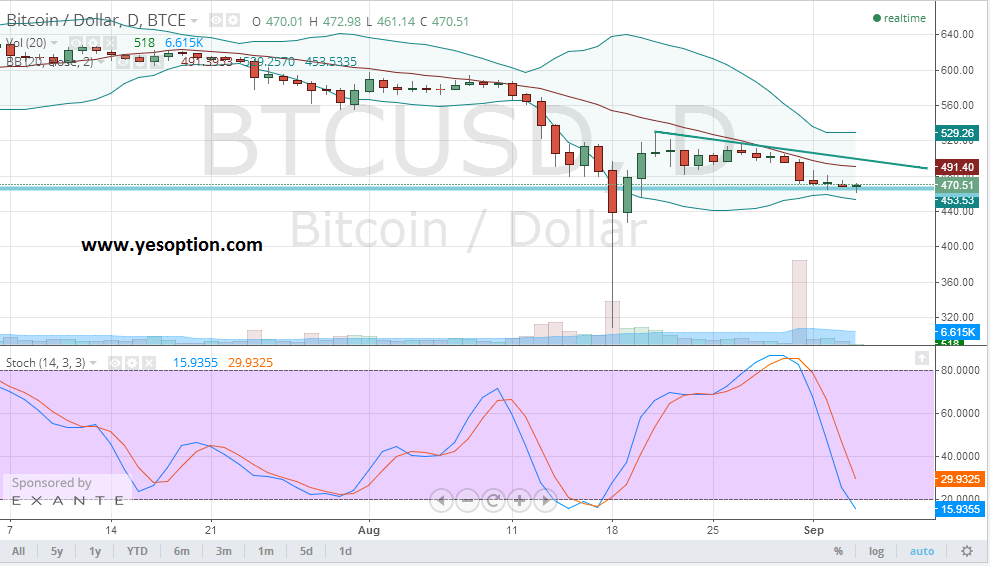

BTC/USD had a very flat session yesterday. The prices opened flat but saw some selling which saw the digital currency hit an intraday low of $458 but buying emerged at those levels which pulled the prices back and closed near the highs of the session. The price action though was very contained and traded in a very narrow trading range. On the downside $453 remains to be strong support for the BTC/USD and on the upside the first level of resistance for the BTC/USD is around the $472 level. Only a move in either direction would confirm to the future direction for the BTC/USD. The stochastic oscillator for the BTC/USD is currently trending in bearish territory but hasn’t given any reversal signals.

Actionable Insight:

Short BTC/USD if it breaks below $453 with a short term target of $380

Long BTC/USD if it breaks above $472 for a short term target at $500

Indonesia has reported a milestone development in bringing its majority of more than 200 unbanked populations closer to Bitcoin world. Bitcoin Indonesia has developed the project in association with exchange Bitcoin.co.id and iPaymu, under which, Indonesians will be able to buy bitcoins over the counter at more than 10,000 'Indomaret' convenience stores. People could get bitcoins in their account by simply creating an account with Bitcoin.co.id after which they will receive a code that would enable them to exchange cash for Bitcoin at the nearest indomaret convenience store. The only shortcoming of this system is the need of internet connectivity; however, Bitcoin Indonesia is on a lookout to eliminate the same.

The world is fast changing attitude for Bitcoin, which could be explained from the recent Internet Policy Review submitted by a Google policy advisor, Andy Yee, who heads the company's Asia-Pacific division. In his article, Yee recommended that the Bitcoin economy has many layers which should be brought under regulatory ambit as per the current digital frameworks. According to Yee, businesses that are in direct connection with investors or consumers should be covered under some regulations. He added that the regulations should not impede the massive innovative potential of the Bitcoin but rather should address the wider concerns about the safety of the currency.

Lastly, the Bitcoin growth has taken long strides, but CoinOutlet still sees space to bank upon the opportunities through its latest and low cost two-way bitcoin ATM. The unit is priced attractively at $8,000 and is competitive when compared to existing ATM units offered by Robocoin and Lamassu. CoinOutlet's founder and CEO Eric Grill perceives that the Bitcoin ATM space has much room to expand and can serve as a route to new types of financial and wealth management.