By: Ben Myers

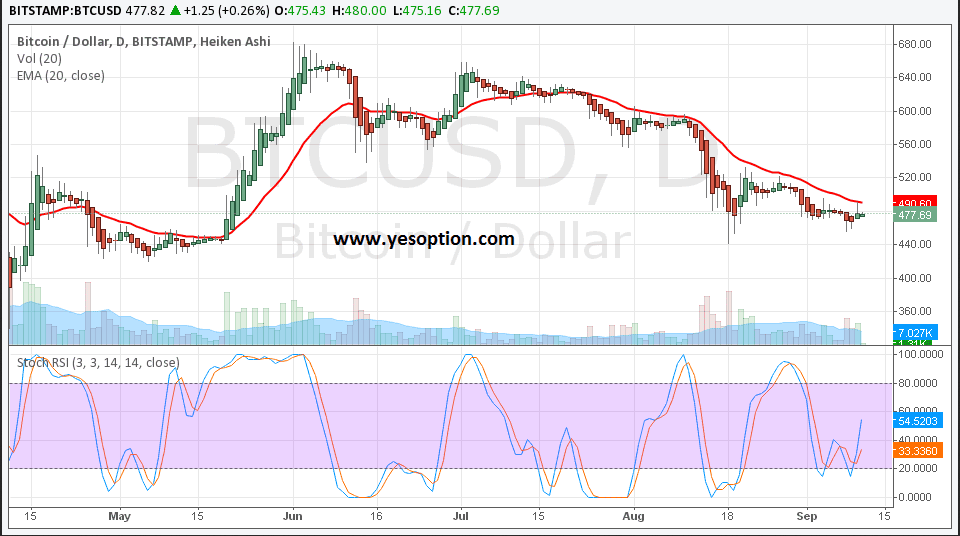

BTC/USD opened at $477.87 and continued to gain till $492 before settling down to trade at $477.87. The currency pair has bottomed out near $455 and is making all efforts to move up in short term, one good news for bull is that the volume is increasing day by day and the momentum indicator Stoch RSI has also given a buy signal.

The unveiling of ApplePay by Apple has brought the bitcoin once again in row of arguments that whether the new pay mechanism will put an end to the virtual currency. Many believe that ApplePay is not threat to bitcoin rather an opportunity that could take the virtual currency to a new level. Firstly, Apple's ecosystem is closed and secondly, it is expensive. The two factors present a valuable opportunity to virtual currencies, which are open and are virtually free. Most importantly Apple has a track record of influencing consumer behavior and thus, with Apple Pay could bring soon make users habituated to using new form of payments over the traditional ones. Once this behavior set in then there is no turning back as people will want more convenience and value for money and that is exactly when the digital currencies could set the stage up for themselves.

While bitcoin community is keeping their attention on ApplePay developments, Coinbase is engaged into its own work of extending the reach of the digital currency to other regions. In this direction, Coinbase is planning to roll out its services to nearly 13 countries in Europe, which will include, France, Netherlands and Italy. Coinbase will let users buy and sell bitcoins in exchange of euros. Bitcoin could only reach mainstream if it reaches in the hands of more people and that is exactly what Coinbase is all up to.

Actionable Insight:

Buy BTC/USD above $483 for target of $490, $498 with stoploss of $477