By: Ben Myers

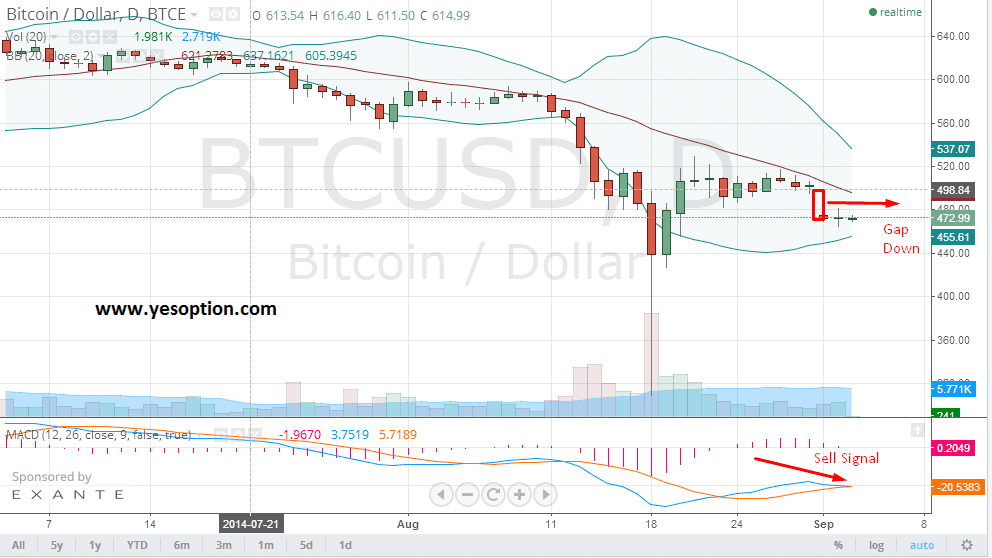

BTC/USD had a very flat session yesterday. The formation of a doji candlestick on the daily charts shows the indecision between buyers and sellers. BTC/USD has traded in a very narrow range over the last couple of days post the selloff witnessed on Friday where it opened gap down. The momentum indicator for the BTC/USD has given a fresh sell signal, which is confirmation of the shift of momentum towards the sell side. The resistance for the BTC/USD on the upside comes near the $496 level, which is also its 20-day moving average. On the downside, the support comes at around $455. Only a breach on either side would provide traders and investors with a clear picture of the future direction for the digital currency.

Actionable Insight:

Short BTC/USD if it closes below $455 with a short-term target at $380 with a stop loss at $475

Bitcoin is certainly a dominating subject among currency players, who are confident that the virtual currency has brilliant future, however, a closer look reveals that still a large fragment of population across countries are not actually acquainted with the functioning of the cryptocurrency. Unlike fiat or other currencies, which are widely accepted among the public, Bitcoin has to still find its place among the masses. Though the Bitcoin propellers are trying to communicate the effectiveness of the virtual currency through several conferences, some believe that spreading awareness right to the doors of people could only solve the problem of identity crisis.

In this direction, one of the organizations had started the initiative called BitComp to encourage the innovative ideas in the field of Bitcoin. The project received ample participation, where winners amassed as much as $20,000 under various categories. However, an innovative idea titled 'Ethos' claimed the grand prize of $5,000. MIT Media Lab students, Amir Lazarovich, Guy Zysking and entrepreneur Oz Nathan conceptualized the idea. Ethos offered a technology to modify the way personal data are shared and stored online, a technique most sought in the bitcoin world.

At the same time, Michigan is becoming an example of a successful farming and bitcoin collaboration. Arbor Hills Farm, which has a task of leasing land of the bigger property like Tilian Farm Development is doing so in bitcoins. Moreover, even the produce of vegetables and livestock too are being sold in bitcoins. The owners of Arbor Hills Farm have been able to do so through integrating bitcoins by setting a system called Community Supported Agriculture (CSA); and they are planning to expand their setup further.