By: Ben Myers

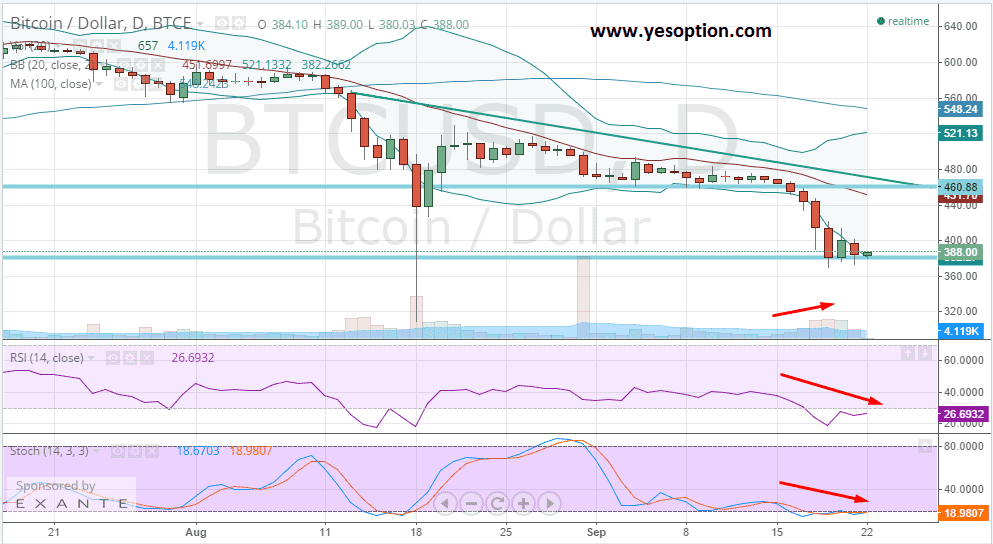

BTC/USD, which has been in a very narrow trading range over the last many days, has given a breakdown from the all-important support zone at $423 and has broken below the key psychological support zone at $400. The digital currency currently has taken support at the $387 level. The breakdown in price was on the back of above average volumes, which is a cause of concern for traders and investors.

A huge positive for the Bitcoin came in the form of Spain acknowledging the digital currency as an electronic form of payment. The news may well be the opening that Bitcoin investors have been looking for since its inception. Bitcoin investors and traders always wanted the currency to be recognized as a legitimate form of payment by a governmental agency. The treatment of Bitcoin as a currency and not a financial asset is a huge positive and contradictory to what the US has done.

Spain has also seen the rampant usage of Bitcoin as a form of payment at its fashion districts, which is also being seen as a huge positive. Also, the creation of a two-way kiosk ATMS’ from companies like BitOceam Technologies is being seen as a positive game changer for the industry. The kiosks would allow buying and selling of bitcoins as well as support a multi-currency exchange and the company believes it would abide by all rules and regulations.

It is imperative to know that the BTC/USD currently trades below all its important daily moving averages. The relative strength index currently trades in the bearish territory and shows no signs of a reversal. Similarly, the stochastic oscillator is currently trading in the oversold zone but is showing no signs of a reversal that is indicative of the bears having the upper hand.

Actionable Insight:

Short BTC/USD at current levels for a short-term target at $342 with a strict stop loss above $408