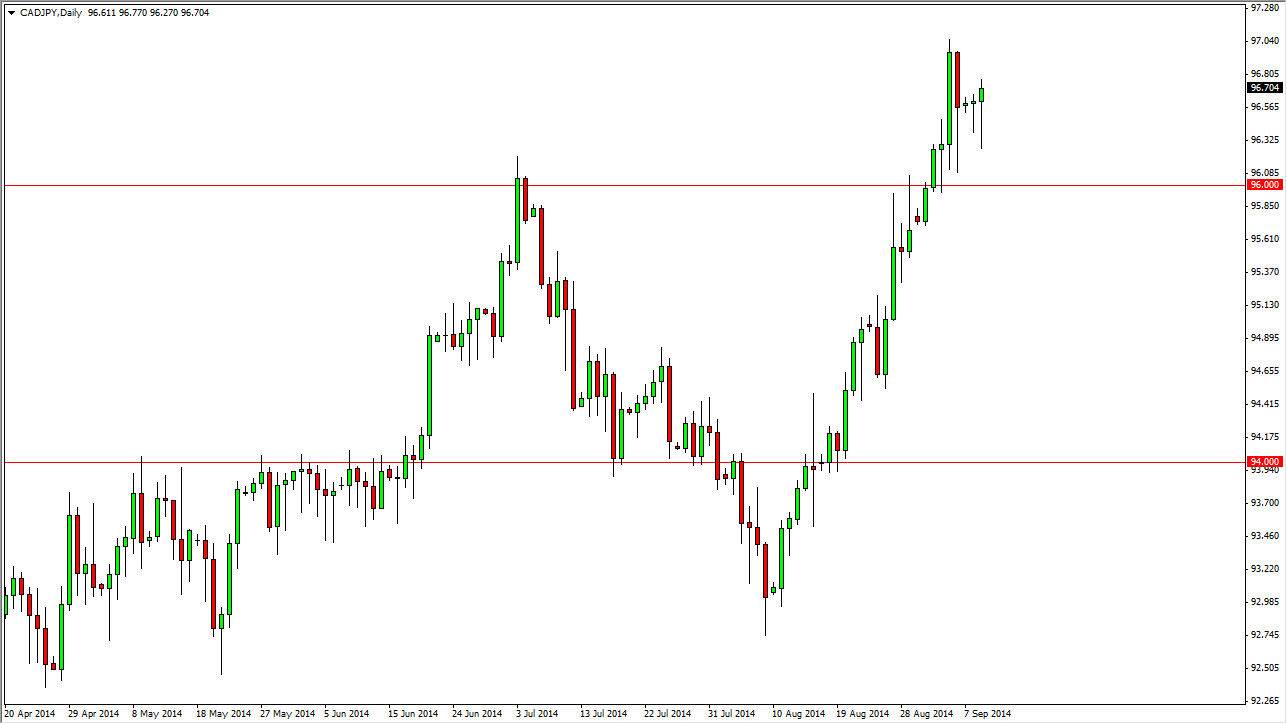

The CAD/JPY pair initially fell during the course of the day on Tuesday, but as you can see found enough support below to turn things back around and form a nice-looking hammer. It appears to me that the 96 level is starting offer a significant amount of support, and with the Japanese yen in general been sold off drastically, it makes sense of this pair should continue to go higher. The Bank of Japan certainly continues to look very weak, and I believe that Canada is much closer to tightening its monetary policy than Japan as.

We broke above the 96 level if you sessions back, and now we have retested it several different times. I believe that ultimately we are going to the 100 level, and as a result this is a “buy only” type of market at the moment. That being said, oil does have an effect on this currency pair, and if oil goes higher, that could really turbocharge the move higher.

Bond yields nothing, traders search for swap.

The bond markets around the world are yielding almost nothing at this point in time. Traders who are looking for some type of return are being pushed into the currency markets in order to make some type of return. Not only do higher-yielding currencies attract people, so do dividend stocks, and for the same reason. With that being the case, this is essentially an investment if you have the ability to hang onto the trade for a longer amount of time.

We may grind around in this is region at the moment, but I do think the 100 will be targeted. I believe that 96 is without a doubt a “floor” in this market, and it 94 will be even more supportive. That being the case, I believe that this market should continue to offer plenty of buying opportunities off of short-term charts, and therefore could be used by a short term trader, as well as a long-term trader as it’s essentially a “two speed” market, with both gears moving higher.