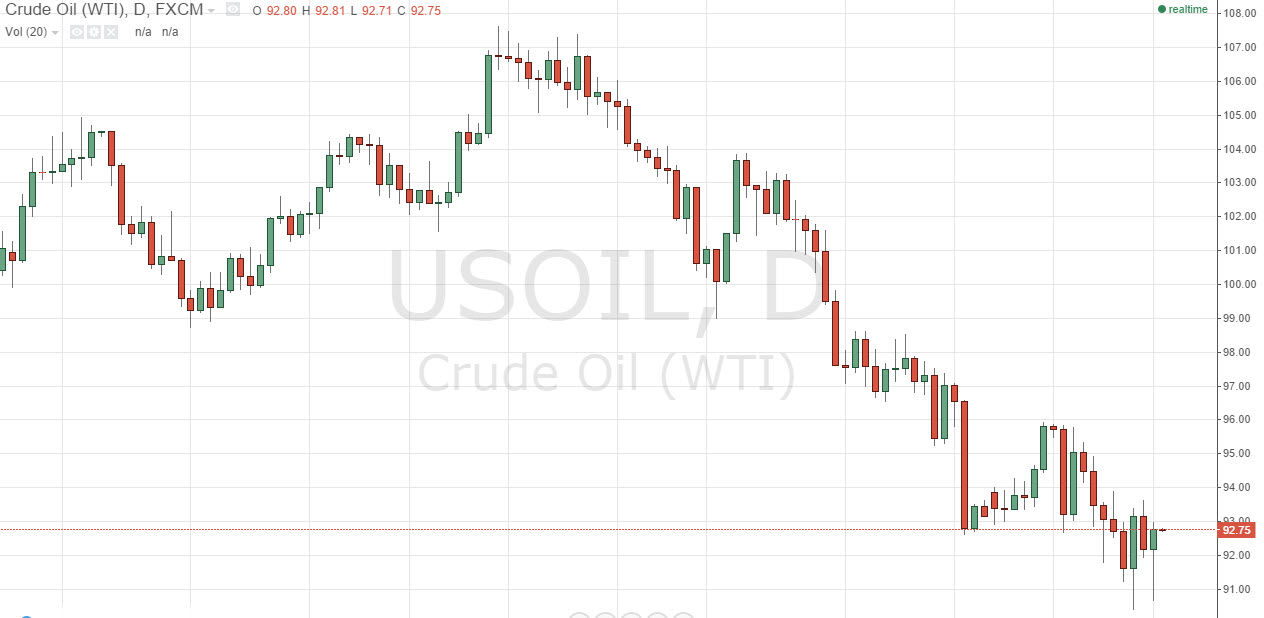

The West Texas Intermediate grade of crude oil had another negative session for most of the day on Monday, but found support just below the $91.00 level in order to bounce and form a nice-looking hammer. This hammer tells me that perhaps we will try to break above the $93.00 level, but quite frankly if we do go higher, I believe that we will eventually get a nice selling opportunity as the $96.00 level above is so resistive. If we do break higher, I think it’s simply an excuse to sell at a higher level.

Do keep in mind that there are API Weekly Stock numbers coming out during the day, and that could of course have an effect on oil prices if it turns out that there is a significant amount of demand coming out of the United States through that announcement. Ultimately though, I don’t see things changing that rapidly, and I think that any bounce at this point in time is going to be a short-term one at best.

Go with the flow.

The trend of course is very negative, and I don’t see this changing at this moment in time. Yes, I do see that we could have a potential bounce here, but at the end of the day I think that we need to see a much more significant positive announcement or turn of events in order to start buying for any significant amount of time. I’m just simply going to wait until we get a resistant candle above in order to continue selling. A daily close above $96.00 of course is enough of a change in attitude for me to start thinking about going long, but until that happens I’m not interested.

The $90.00 level below should be massively supportive, so I’m not necessarily expecting any type of major breakdown. However, if we broke down below that level, we could in fact see this market come completely undone. That seems to be very unlikely at this point though, so having said that I feel that short-term selling opportunities after rallies will be the way to go.