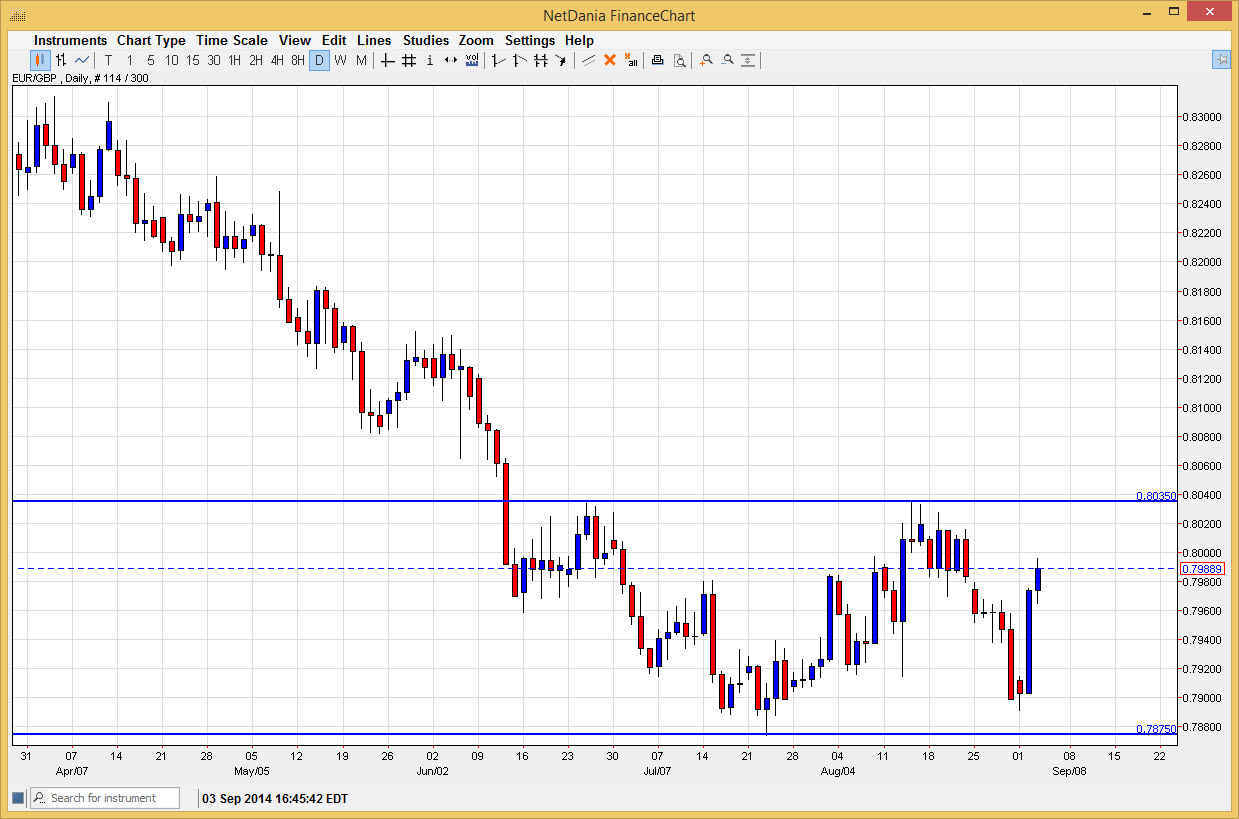

The EUR/GBP pair rose during the course of the day on Wednesday, but as you can see found a bit of resistance at the 0.80 level. However, there is still significant resistance above, and I do not think that this market breaks out to the upside until we get above the 0.8035 handle. Any resistive candle between here and there for me is a nice selling opportunity as this market is most certainly in a downtrend, and that of course would go quite well with the trading conditions that we have seen for the last several months.

I believe that this market will stay within the recent consolidation area, which means that the 0.7875 level will of course end up being supportive. As long as we stay within this area, I believe that you can trade this range bound market for small gains in one direction or the other, thereby taking advantage of a market that is well defined.

Both of these currencies are hated.

Both of these currencies are hated by most traders around the world, so as a result it’s difficult to imagine one of them suddenly becoming en vogue. With that being the case, I think that we will continue to go sideways, but I am much more comfortable selling obviously as the trend is most certainly bearish. In fact, I think that if we break above the 0.8035 handle, we could see a trend change in the making. Until then, I think that this market will continue to be sold off.

Below the 0.7875 handle, we could see a significant amount of bearish pressure as the market would then head to the 0.75 level. That of course would continue the downward pressure that we have seen for some time, and as a result I believe that the sellers would step back into the market with massive amounts of money to push it back down. On the other hand though, to break higher would not only break above horizontal resistance but also the possible trend line that has been keeping this market down for some time. In the meantime, I am looking for short-term trades, but aware of the possibility for larger trades.