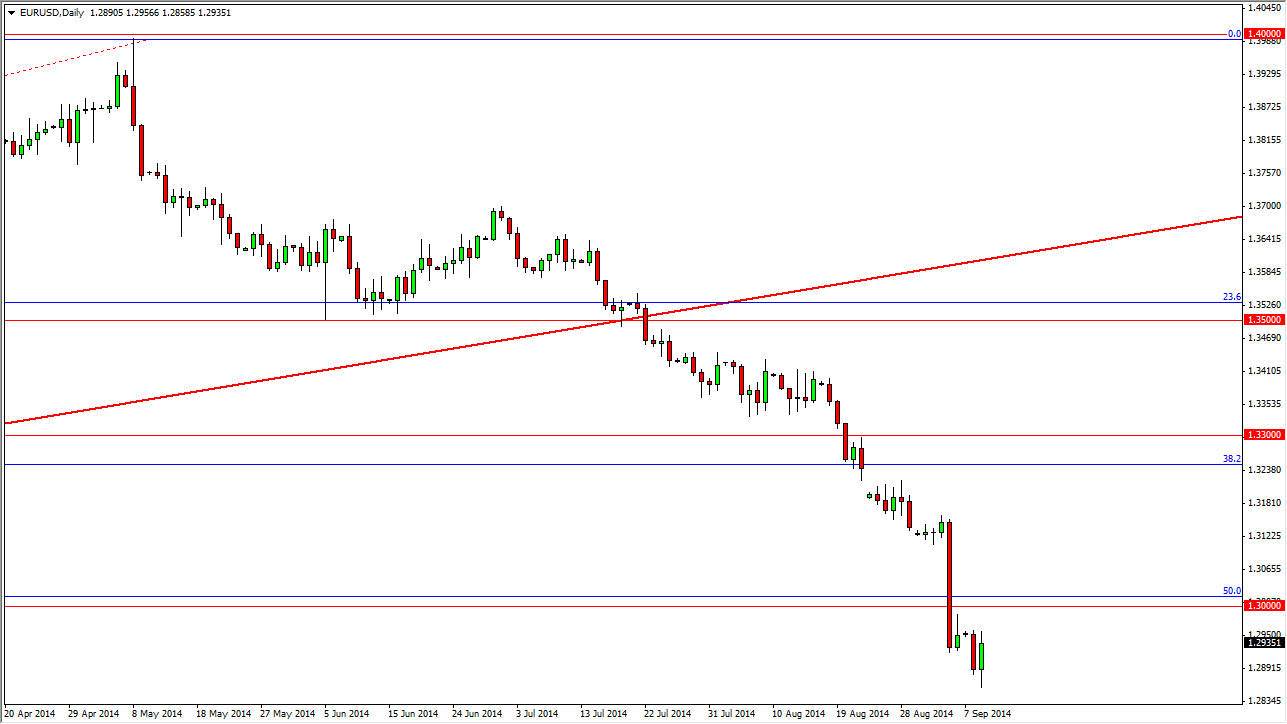

The EUR/USD pair fell initially during the session on Tuesday, but I believe that this market has simply fallen too far and into short of an amount of time. Because of this, the market rising formed a relatively supportive candle, but this should simply be a situation where you can sell rallies. After all, the 1.30 level should be significantly resistive, and with that I am still looking for short-term charts in order to continue the downtrend that we’ve seen.

There is a gap above that the 1.3250 level, and as a result I believe that area should be massively resistant. It is not until we get above there until I would even remotely consider buying this market, so this point time it’s simply a matter of looking for short-term opportunities. I believe that we are still heading to the 1.28 level, which is much more supportive on the longer-term charts.

The Euro looks weak everywhere.

The Euro in general is very weak. It’s not just against the US dollar, but of course the US dollar is one of the strongest currencies in the world at the moment. I see Euro weakness against several different currencies, so it obviously makes a lot of sense that we continue to sell off against the so-called “safety currency.” That being the case, I will continue to sell every time this market rallies, and aiming for small gains in favor of the US dollar.

I believe that the 1.28 level will massively be supportive, but if we break down below there the Euro will absolutely collapse at that point. However, it’s difficult to imagine that happening in such a brutal manner, simply because it seems like no matter what happens, so we simply willing to buy the Euro. Do not forget that there are other pairs out there that can be sold as well, as the Euro should have more room to move against other currencies. Either way, you can sell this on a short-term bounce, or simply use this pair as a peripheral indicator for other currency pairs involving the EUR.