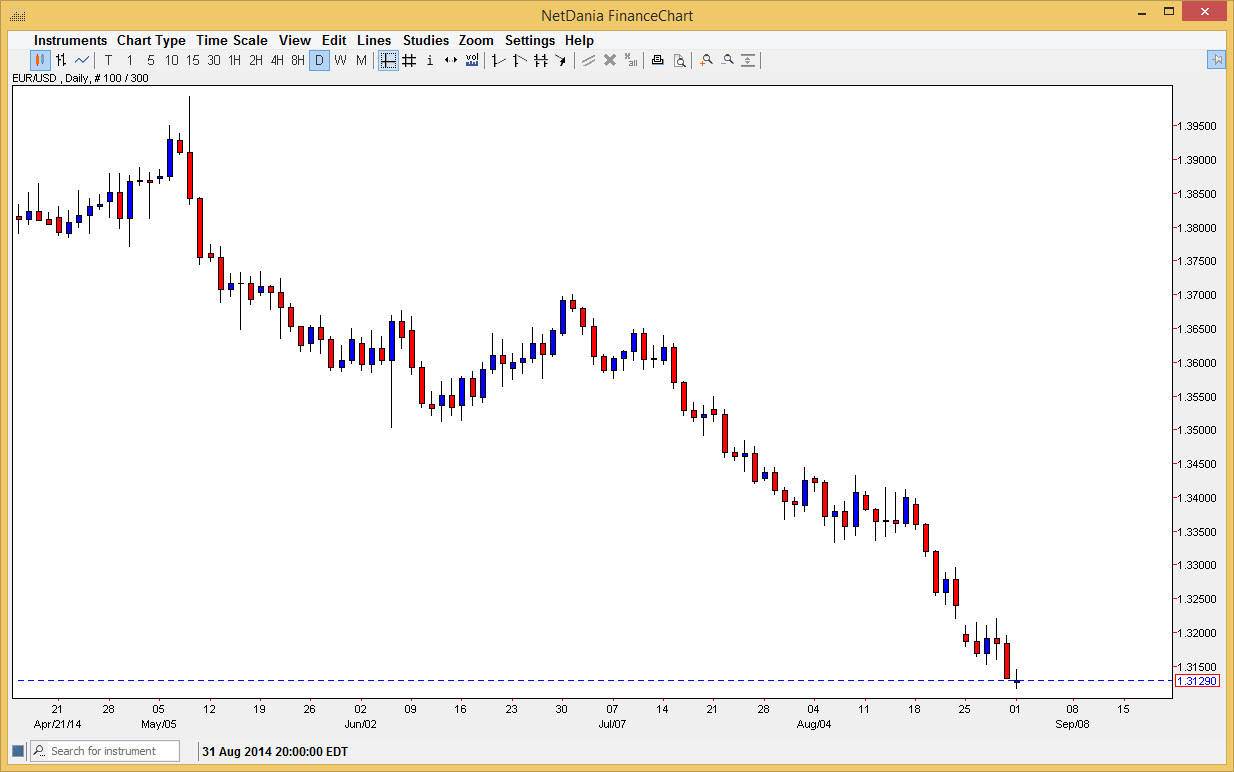

The EUR/USD pair did almost nothing during the session on Monday, which of course makes a lot of sense considering that the Americans and the Canadians both were celebrating Labor Day. Nonetheless, I believe that this market will continue to do what is done for some time, fall. I think that 1.32 level will continue to be a massive barrier, and as a result any rally at this point in time should be a nice selling opportunity. Adding more fuel to speculative fire, the ECB has an announcement later this week as far as interest rates are concerned. While I do not expect to see them ease monetary policy, I do think it’s coming fairly soon, just as the rest of the market does.

With that being the case, there’s no reason for the Euro to have any significant gains against the US dollar. The Tuesday session features the ISM Manufacturing PMI numbers, and a strong reading could in fact have money flowing to the US dollar anyway. That would only exacerbate the selloff that we have seen in this pair, and as a result I feel that could get a little bit of a boost to the value the us dollar overall.

Don’t fight the trend, this move isn’t over.

Quite frankly, this move isn’t anywhere near over. Because of this, I feel that we need to look for the next logical support level, the 1.30 handle. It’s down there where I would expect to see buyers step into the marketplace first, but truth be told I feel that the real support is lower - down at the 1.28 handle, which of course gives us plenty of room to the downside. I think that even if we do rally at this point, the 1.3250 level will be far too resistive to break over and above, meaning that if we rise in value I am only looking to pick up the US dollar “on the cheap.” We also have nonfarm payroll numbers coming out this week, and that of course can move the market as well.