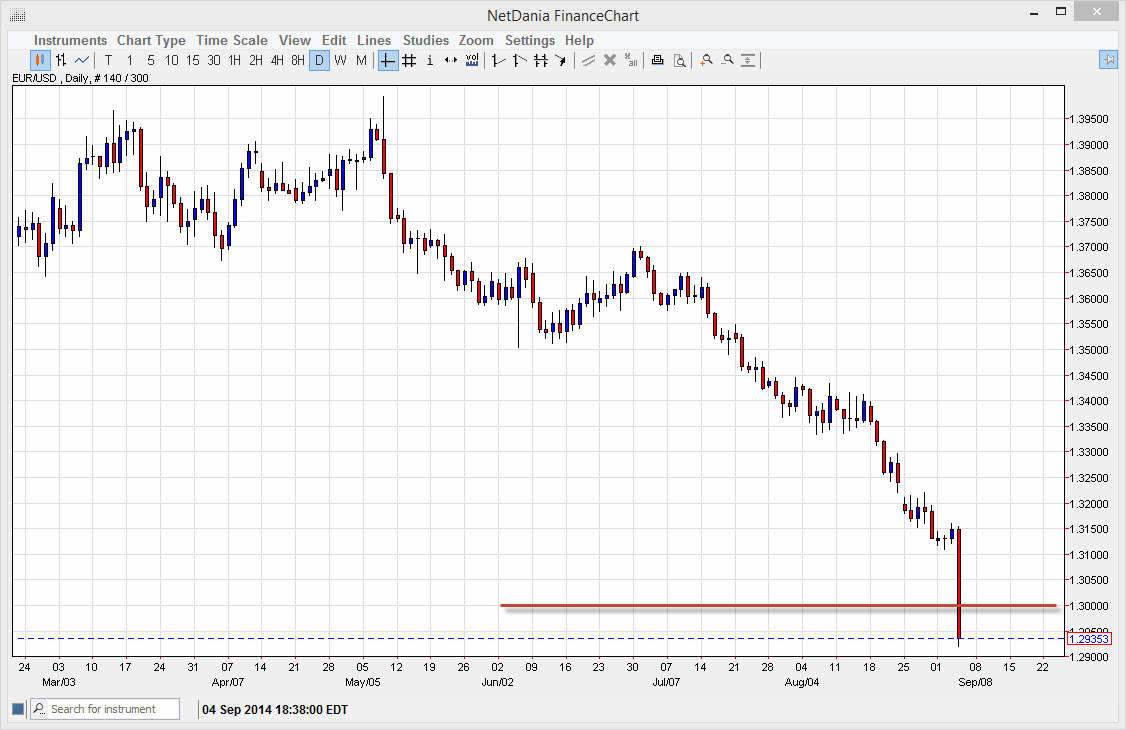

The EUR/USD pair fell hard during the course of the day on Thursday, with the European Central Bank surprising the market with a completely unexpected interest-rate cut. With that, the value the Euro was pummeled against most currencies, with the dollar being especially interesting as the Federal Reserve is looking to tighten its monetary policy. With that we have two central banks that are diametrically opposed, and that means that the market should continue to favor the US dollar over the Euro, as interest-rate differentials will continue to diverge.

The size of the candle of course suggests that the selling pressure took over, and that the market will continue to fall from here. Also, we broke down below the 1.30 level, which obviously is a large, round, psychologically significant number. The support level giving way of course is a bearish sign in this market place, and because of that I believe that the market will continue to sell off every time there’s a slight rally.

Nonfarm payroll

The nonfarm payroll numbers coming out of course will have a massive effect on the market going forward, and with that I believe that if we get a decent jobs around the United States, this will favor the US dollar over most other assets, most especially the Euro as deflation is a serious concern at the moment.

I also believe that the 1.30 level will offer resistance, and I would love to sell some type of resistant candle in that general vicinity as I believe we are ultimately heading down to the longer-term target that I had established a while ago, the 1.28 level. The 1.30 level been broken down through so quickly was a bit of surprise, but obviously with a central bank cutting interest rates and a surprising manner, the market was caught off guard. I believe that the market cannot be bought into we get above the 1.3250 level at the very least, something that I do not anticipate seeing anytime soon. With that, I am very bearish of this market and will continue to buy the dollar.