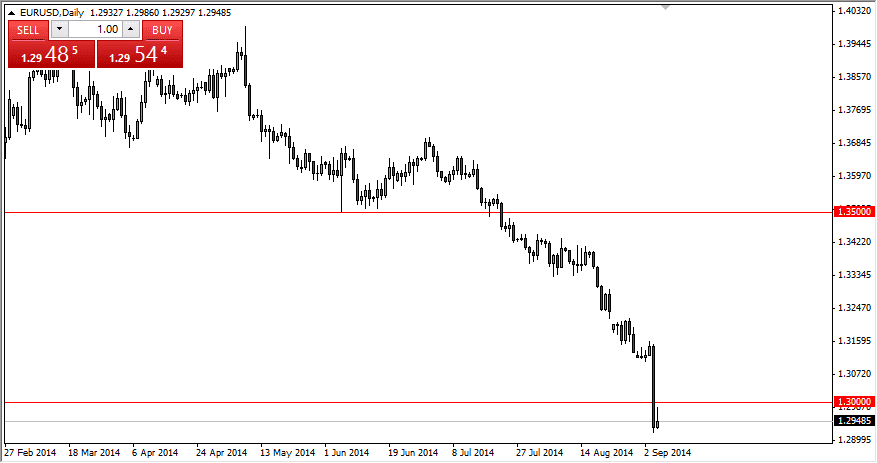

The EUR/USD pair initially rallied during the Friday session as the jobs number came out a bit disappointing. The reality is that the European Central Bank cutting rates on Thursday is of course the one thing that people are going to be paying attention to, and the break down in the pair below the 1.30 level signals that we are in fact going lower given enough time. The ECB will continue to be easy as far as monetary policy is concerned, and this is diametrically opposed to the Federal Reserve and its cutting back on quantitative easing. With this, the interest rates in the bond markets will continue to drive money from Europe to America.

Because of this, the market sold off later, and as I believe – nobody really believed the number. After all, the economic numbers out of America have been stronger lately, and this of course is completely different than the jobs number would have suggested. With that, A sold a bit more of this market as well during the day, and the 1.30 level repelled the knee-jerk reaction to the upside.

Continued bearishness

The pair should continue to be bearish, especially now that we have broken below the technically significant 1.30 level. I see quite a bit more in the way of support down at the 1.28 level however, and as a result – that is my true target. I think selling rallies as they appear on the short-term charts will be the way to go going forward. I think that we are going to see continued Euro weakness for the rest of the year, and as a result – I am short or either flat in this market. I have no interest in going long as there are simply far too many things that could go wrong.

Also, the markets will continue to look for safety from time to time, as the world is increasingly hostile, and the “safety trade” may come into play as the US Dollar is one of the “safest” instruments to trade in the world. With that – I am short.