EUR/USD Signal Update

Last Thursday’s signals were not triggered and expired.

Today’s EUR/USD Signals

Risk 0.75% of equity.

Entries must be made between 8am and 5pm London time today.

Short Trade

Go short following a strong lower high after a major high once 1.3000 is broken to the up side.

Place a stop loss 1 pip above the local swing high.

Take off 75% of the position when profit is double risk and leave the remainder to run.

EUR/USD Analysis

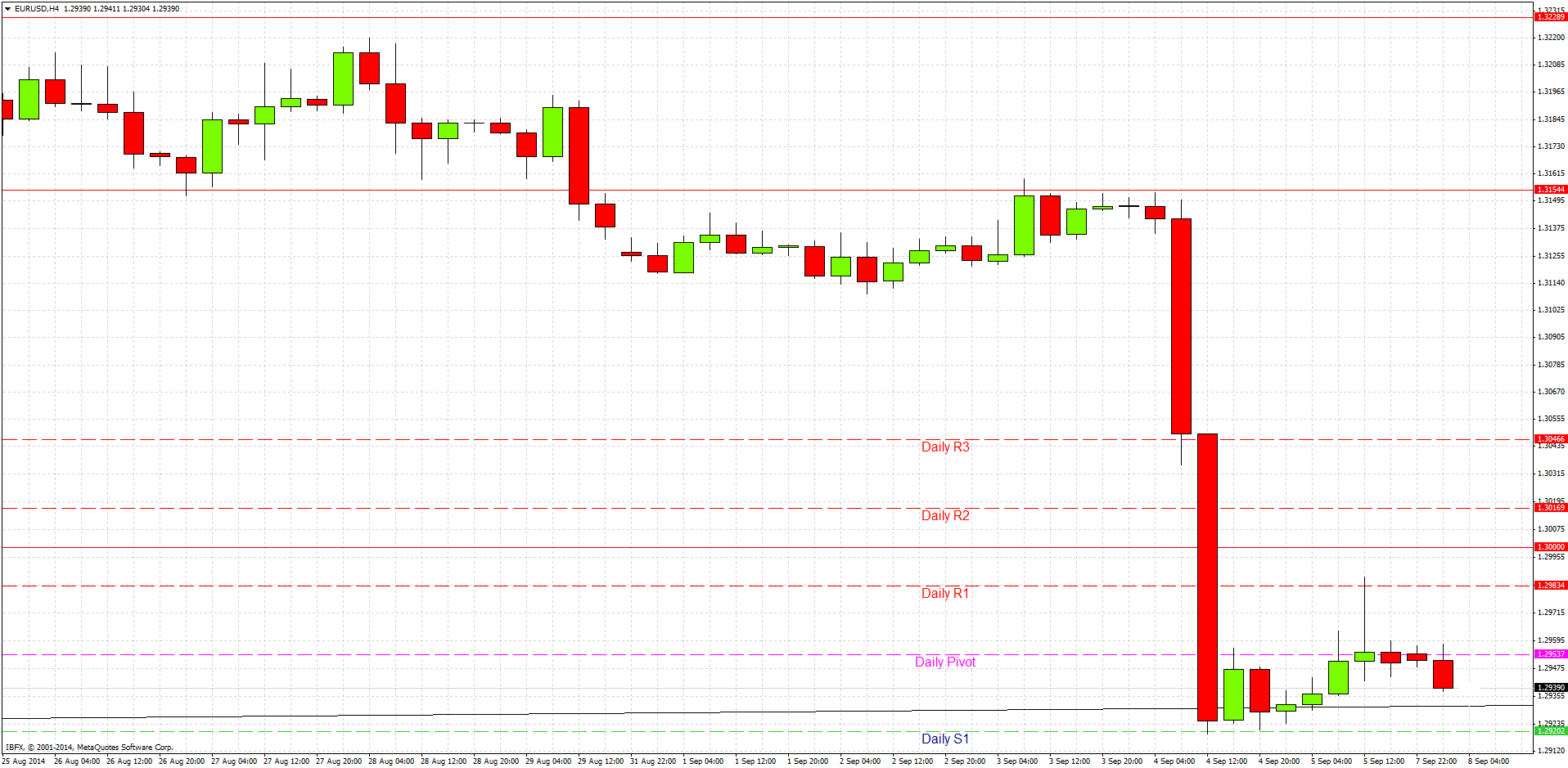

This pair fell very dramatically Thursday after the ECB announced a rate cut of 10 basis points. The EUR now has the lowest base interest rate of any major global currency. Following the announcement, the EUR dropped like a stone, cutting effortlessly through all support. The price finally stabilised at an old bullish trend line which sits at around 1.2930 which has not been touched since July 2013: we are now at lows that this pair has not seen for more than 1 year.

In this kind of runaway environment it is hard to find good levels to trade off. It would be foolish to think of any long trades just yet, although this pair does tend to pull back after sharp drops. The most logical resistance nearby will be the psychological level of 1.3000.

Below the bullish trend line, there is no obvious support until the very strong double bottom that was formed last year at the key psychological level of 1.2750. My colleague Christopher Lewis also has a strongly bearish bias, but sees the support a little earlier than me, at around 1.2800.

There are no high-impact data releases scheduled today concerning either the EUR or the USD. It should be a quiet day.