EUR/USD Signal Update

Last Wednesday’s signals expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75%

Entries should be made only before 5pm London time.

Short Trade

Go short following bearish price action on the H1 time frame following a first touch of 1.2756.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the trade is 50 pips in profit.

Take off 50% of the position as profit when the trade is 50 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

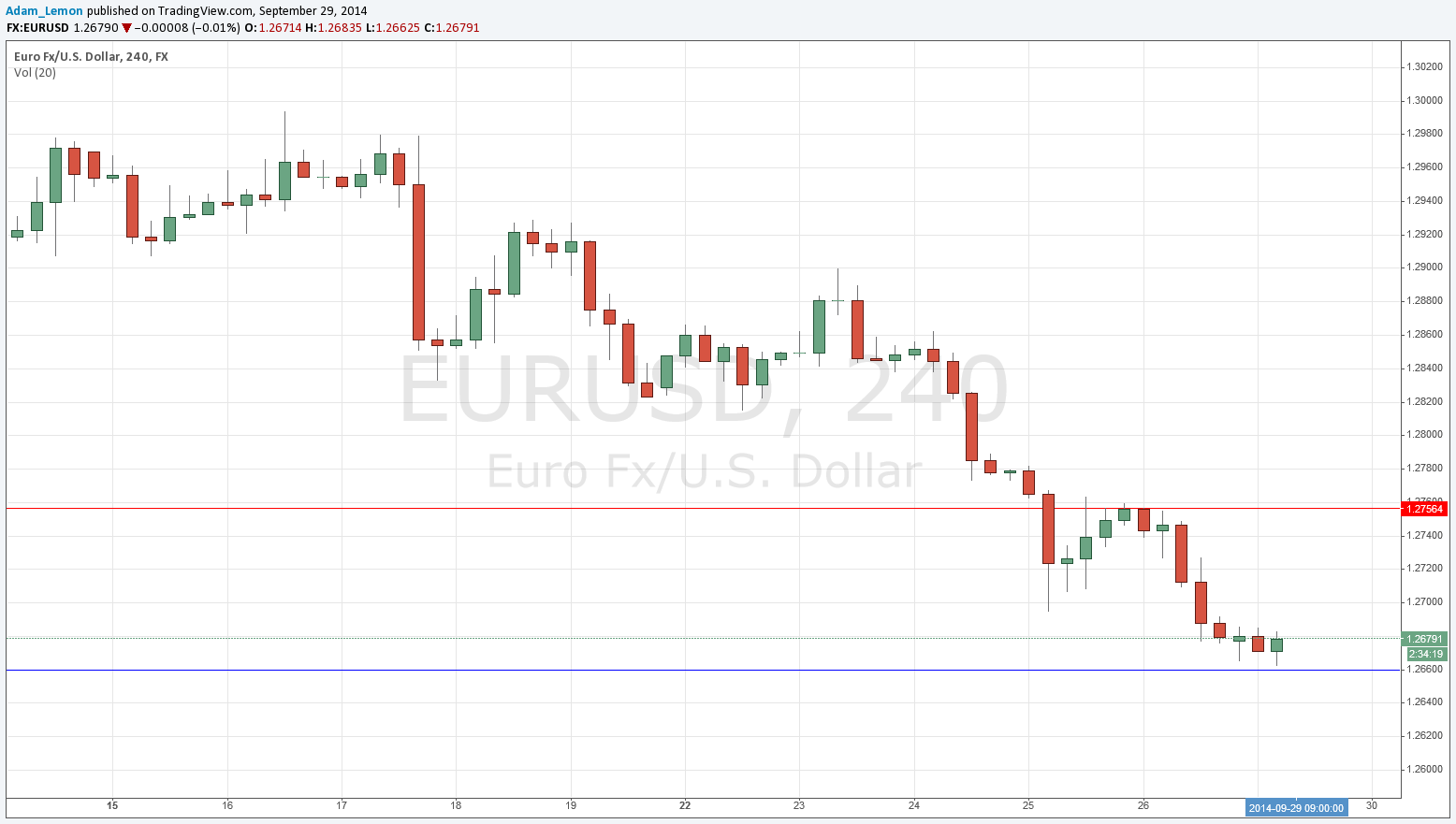

In my final forecast made in the middle of last week, I wrote that this pair was stuck between significant levels of support and resistance at around 1.3000 above and 1.2750 below the current price, and took an overall bearish bias.

Recent days have confirmed this, as the USD continues its strong onwards march and the EUR continues its decline. We broke below the 1.2750 level, reaching a 1 year low this morning just above 1.2660. At the time of writing, the price is rising from there.

It seems that the 1.2750 area has flipped from support to resistance, as it was the source of the recent move down last Friday. There is a bit of flexibility there, and I maintain a short bias, so if we get to 1.2756 today that would be an acceptable level at which to look for shorts.

There is a level just below us which is quite likely to be supportive and we may already have made the low of the day just above it. The level is 1.2660 and it is significant because it was an inflective monthly low from 2013. Very brave counter-trend traders might look for a long there.

Below that, 1.2636 is also likely to be supportive.

There are high-impact data releases scheduled for today which are likely to affect the EUR, but nothing concerning the USD. There will be releases of preliminary German CPI data at unknown times of the day.