EUR/USD Signal Update

No signal was given yesterday.

Today’s EUR/USD Signals

Risk 0.75%

Enter before 5pm London time.

Long Trade

Go long following bullish price action on the H1 time frame following a first touch of 1.2750.

Place a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the trade is 50 pips in profit.

Take off 25% of the position as profit when the trade is 50 pips in profit and leave the remainder of the position to run.

Short Trade

Go short following bearish price action on the H1 time frame following a first touch of 1.3000.

Place a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the trade is 50 pips in profit.

Take off 25% of the position as profit when the trade is 50 pips in profit and leave the remainder of the position to run.

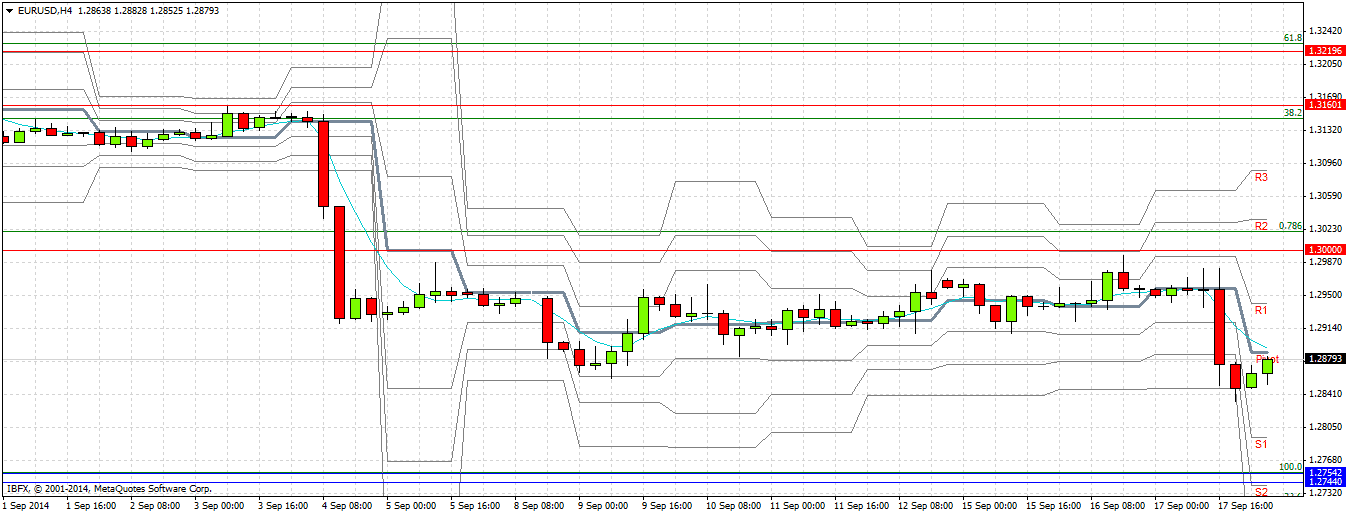

EUR/USD Analysis

I wrote yesterday that a break below 1.2850 following the FOMC yesterday evening should see a further fall down the anticipated support at 1.2750. Although we did break 1.2850, the pair was not able to stay below that level for long, and it pulled back quickly. The pair has been rising ever since. It is worth noting that the EUR has been showing strength against other currencies, so to some extent this is a similar situation to the GBP/USD: a case of strength vs strength. You might be better off looking to trade USD or EUR strength against the JPY instead.

We have been within a range for a while now, with resistance above us at 1.3000 and support below at 1.2750. I would only look for trades off bounces from either of those levels, as I do not see much momentum here.

There are several high-impact events scheduled today concerning both the EUR and the USD. At 10:15am London time there will be a release of Targeted LTRO data regarding ECB borrowing. Regarding the USD, at 1:30pm there will be releases of US Building Permits and Unemplyment Claims data. At 1:45pm the Chair of the Fed will speak and then at 2:00pm there will be a release of the Philly Fed Manufacturing Index. It is likely to be a volatile day for this pair.