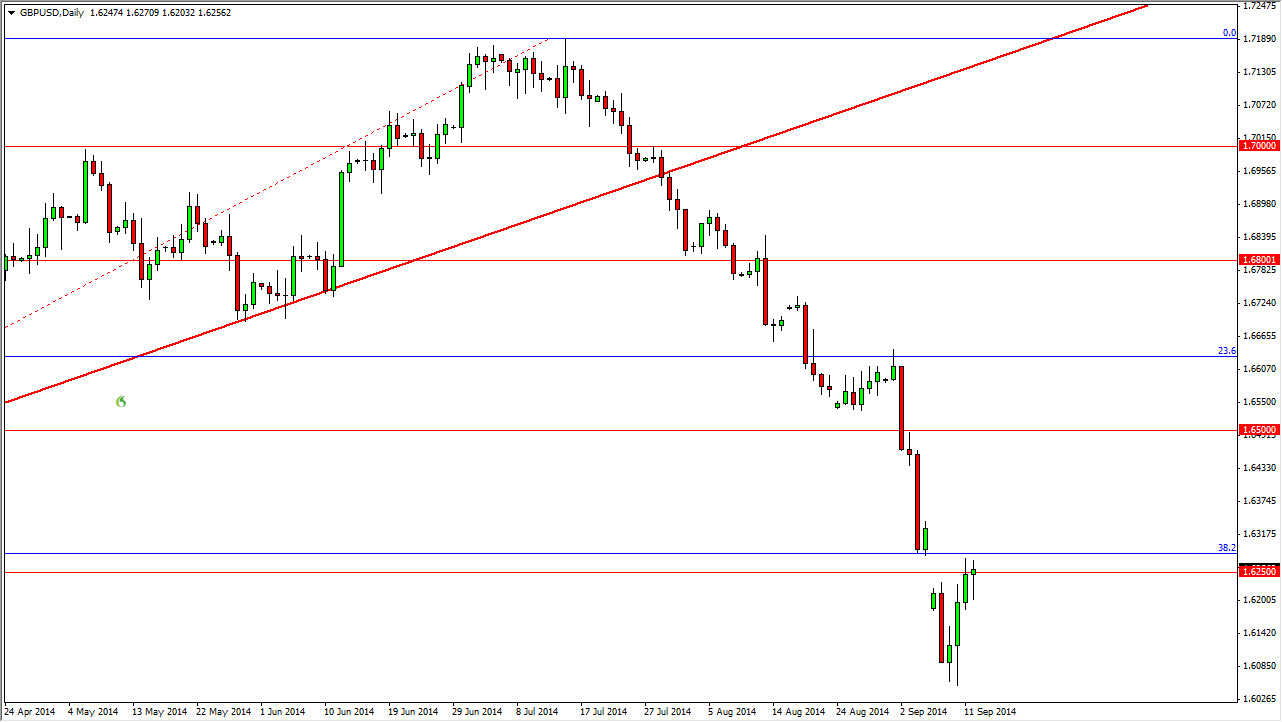

The GBP/USD pair initially fell during the day on Friday, but as you can see the 1.62 level offered enough support to turn things back around and form a hammer. Personally, I believe that most of what’s driving this marketplace is the Scottish Independence Referendum vote coming on Thursday, and I think that the market will continue to be very choppy, at least until that vote comes out. However, I think that we are starting to see the sellers show a bit of fear as there is the possibility that the Scottish stay within the United Kingdom. That being the case, the market will give the British pound a bit of a reprieve.

That being said, I also noticed that on the weekly chart we formed a nice-looking hammer. This hammer of course suggests that we are going to go higher, so with that on a break above the highs from both Thursday and Friday, I would be a buyer the British pound and aiming for the 1.65 level in the short-term. Ultimately though, if the Scottish stay within the United Kingdom, I think the British pound will get a violent move higher. In fact, that’s entirely what I expect.

Sometimes timing the market is about being ahead of the curve.

Sometimes, the so-called “smart money” starts to get involved in the market ahead of time. I believe that hammer on the weekly chart is a sign of this. With that being the case, and the fact that we did get pretty close to the 1.60 handle, I believe that the selling is just about done. Of course, if the Scottish do in fact leave, it would of course be very negative. However, I do believe that they will stay simply because the economic impact would be too drastic for them.

Ultimately, I do think that the British pound continues to go much higher, and we may be seeing the beginning of a longer-term buy-and-hold type of situation. Pullbacks at this point time would be considered value by me, simply because we have fallen way too far.