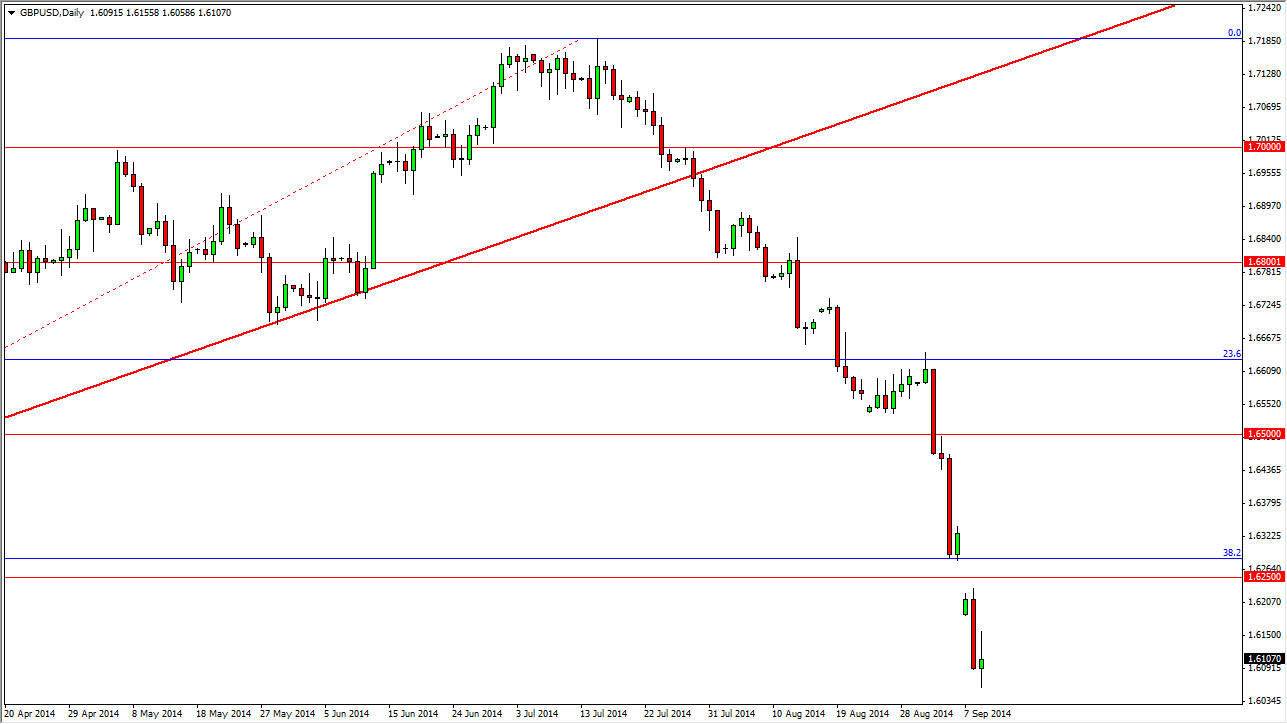

The GBP/USD pair went back and forth during the course of the day on Tuesday, but ultimately decided very little in the end of the day. The market is essentially neutral for the session, but there is no doubt that we are in a massive downtrend. The fact that the candle almost looks like a shooting star really suggests that we are going to continue to see weakness, which is saying something pretty significant considering that the British pound has been so weak to begin with.

Looking at this chart, I recognize that the 1.6250 level was the gap from the beginning of the week, and I believe that it should end up being massive resistance. Gaps tend to get filled, so I will be looking for this market to bounce enough in order to do just that. However, the 1.60 level I believe is the real target. The real question is going to be whether or not we fill the gap first, or we go down there.

One-way trade.

This is one of the sickliest looking charts that I have seen in ages. I think that bounces will invite sellers simply because there is just so much weight on top of the downtrend. The 1.60 level should of course be supportive based upon the longer-term charts, but if we break down below there things could get really ugly for the British pound.

The US dollar will continue to be favored overall, so it makes sense that this trend will continue. However, we certainly have fallen quite a bit and as a result a bounce wouldn’t be much of a surprise. After all, this market has completely fallen off of a cliff and even the most bearish of trader wouldn’t have envisioned this big of a fall in such a short time. With that being the case, I think that the bounce is long overdue, and I am waiting to jump on that instead of trying to short anywhere near this area which to me is way oversold.