GBP/USD Signals Update

Last Thursday’s short signal 2 was almost triggered, but there was not really a major lower high to go short off.

Today’s GBP/USD Signals

Risk 0.75% of equity.

Entries may only be made between 8am and 5pm London time today.

Long Trade

Long entry following bullish price action on the H1 time frame after the first touch of 1.6500.

Put a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price reaches 1.6571.

Remove 75% of the position as profit at 1.6571 and leave the remainder of the position to ride.

Short Trade 1

Short entry following bearish price action on the H1 time frame after the first touch of 1.6655.

Put a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the price reaches 1.6600.

Remove 50% of the position as profit at 1.6600, half of the remainder at 1.6550, and then leave the rest of the position to ride.

Short Trade 2

Short entry following a strong lower high below 1.6631, after 9:45am London time only.

Put a stop loss 1 pip above the local swing high.

Remove 75% of the position when profit is twice risk and leave the remainder to ride

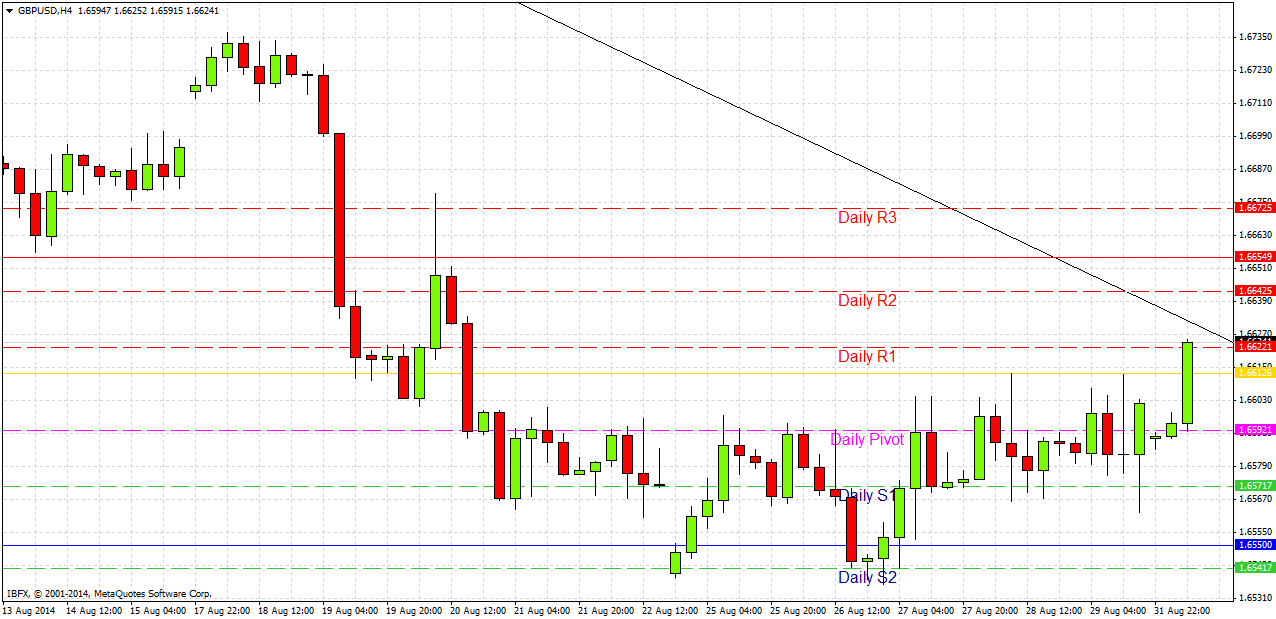

GBP/USD Analysis

This pair has been fairly quiet, continuing to try to break up through the resistance at around 1.6600. It has already exceeded this level in a fairly strong impulsive move in late Tokyo trading this morning, and is now approaching the bearish trend line which has been established for the past 6 weeks.

Although this pair is in a down trend, it has shown strong signs of wanting to pull back over the past few days. The GBP has been showing strength against the EUR and the JPY, so it is only USD strength that is keeping this pair down.

The big question is whether it will break the trend line. If the news release this morning engineers a bounce off the trend line followed by a bearish reversal, it could be a good opportunity for a short trade.

There are no high-impact data releases scheduled for the USD. Regarding the GBP, at 9:30am London time there will be a release of manufacturing PMI data. It is a public holiday in the U.S.A. therefore the New York session is likely to be quieter than the first half of the London session.