GBP/USD Signals Update

Yesterday’s signals expired without being triggered.

Today’s GBP/USD Signals

Risk 0.75% of equity.

Entries may only be made after 12:15pm London time today.

Short Trade 1

Go short following bearish price action on the H1 time frame after the first touch of 1.6550.

Place a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the price reaches 1.6500.

Remove 50% of the position as profit at 1.6500, and then leave the rest of the position to ride.

Short Trade 2

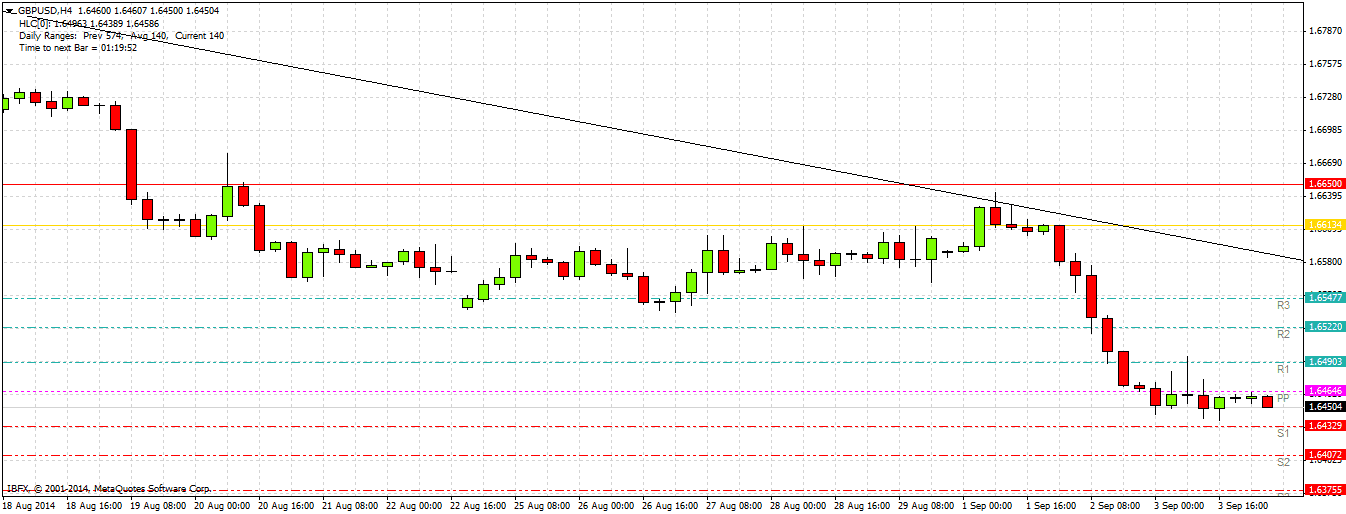

Go short following bearish price action on the H1 time frame after the first touch of the bearish trend line shown on the chart below.

Place a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the price reaches 1.6550.

Remove 50% of the position as profit at 1.6550, and then leave the rest of the position to ride.

GBP/USD Analysis

Yesterday was a quiet day after Tuesday's strong fall. The tendency is still bearish and we are in a strongly bearish trend. The GBP is proving to be one of the best currencies to short against the recent Usd strength. The GBP's weakness is being exacerbated somewhat by the increasing likelihood that Scotland will vote for independence in the referendu scheduled for the 18th of September.

Little is likely to happen before the news releases later today.

There are very high-impact data releases scheduled today concerning both the GBP and the USD. Regarding the GBP, the Official Bank Rate and Asset Purchase Facility will be announced at Noon London time. Concerning the USD, there will be the ADP Non-Farm Employment Change at 1:15pm, followed by Trade Balance and Unemployment Claims at 1:30pm, and then finally ISM Non-Manufacturing PMI at 3pm. It should be a very volatile day, especially if there are any surprises.