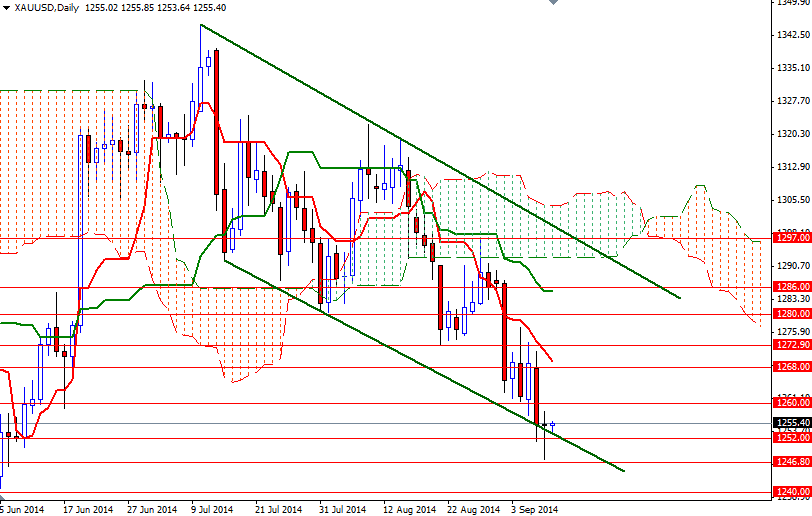

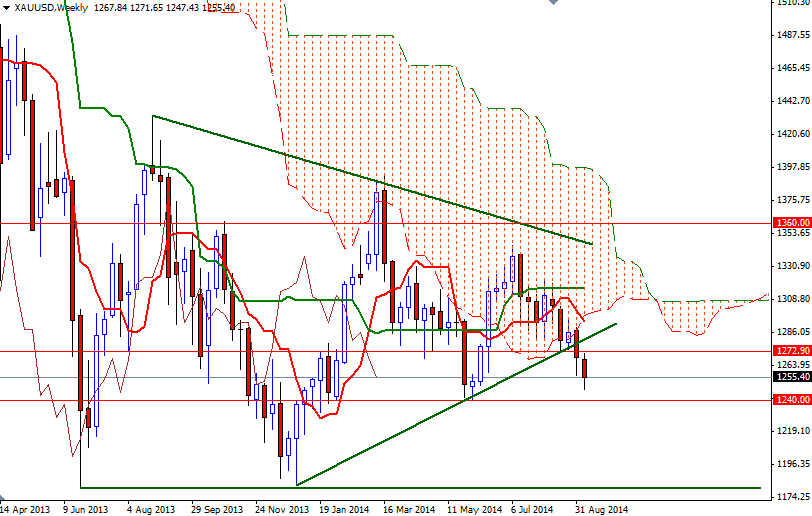

Although gold prices ended yesterday's session lower, the market found support just above the $1247 level. As a result, the pair erased some of the initial losses and created a long shadow to the down side. The market is still feeling the bearish pressure from growing conviction the U.S. Federal Reserve will hike interest rates earlier than expected but pullbacks in major equity markets will certainly be something thing to watch because if stocks take a breather from their recent advances, people may start taking money off the table and use it to bolster their gold holdings.

Another thing that might increase desire for safe-haven diversification is talks of further sanctions against Russia. The European Union is considering expanding sanctions on Russia for failing to rein in the separatists but the business community in Europe doesn't seem to be happy. A set of measures imposed in July prompted Russia to ban agriculture imports from the European Union. Recently, the Russian foreign ministry said that "If they are passed, there will undoubtedly be a reaction from our side".

From a technical stand point, yesterday's candle represents a sign of short-term exhaustion and because of that chasing gold lower might a bit risky. In other words, I expect some short-side profit taking unless the market can penetrate the support at the 1246.80 level. If the bulls manage to hold prices above the 1252 level today, they might have a chance to tackle the 1260 resistance level. I think breaking through this barrier is essential in order to start a journey towards the 1268 level. However, closing below the 1246.80 support level would suggest that the bulls will have to wait a little longer as the bears will be targeting the 1240 support level next. If this critical support gives way, our next stop will be the 1234/1 area.