The XAU/USD pair (Gold vs. the American dollar) fell 1.69% on Tuesday, extending its losses to a third straight session, and touched the lowest level since June 18. The pair accelerated its decline after the bears managed to capture the strategic support levels at $1280 and $1268. In the latest economic data, the Institute for Supply Management's manufacturing index came in at 59.4, up from the previous month's 57.1 and above expectations for a reading of 57.0. Not surprisingly, weakening data from China and intensifying worries over ongoing problems in the Eurozone contributed to gold’s losses as well.

On several occasion I have mentioned that demand for protection against volatility caused by the geopolitical issues has been temporary and failed to ignite an uptrend. Until the conditions in the market place change (steadily improving U.S. economy and heightened appetite for more conventional assets, such as U.S. equities), there will be certain amount of pressure on the precious metal.

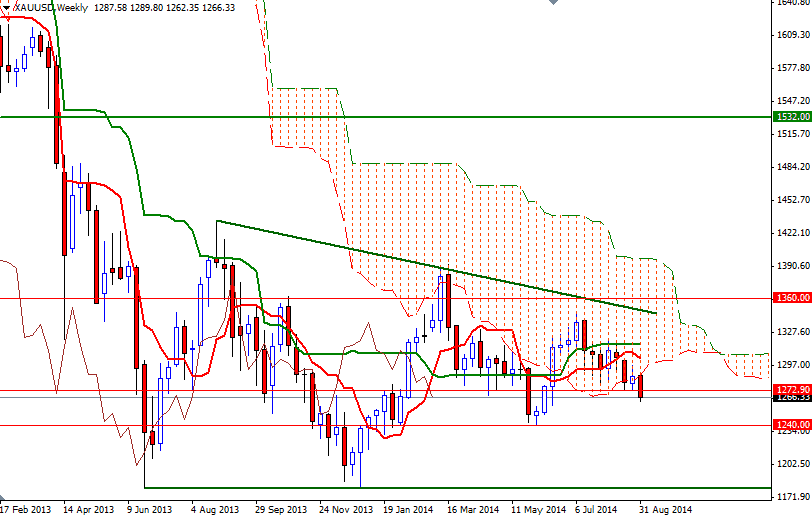

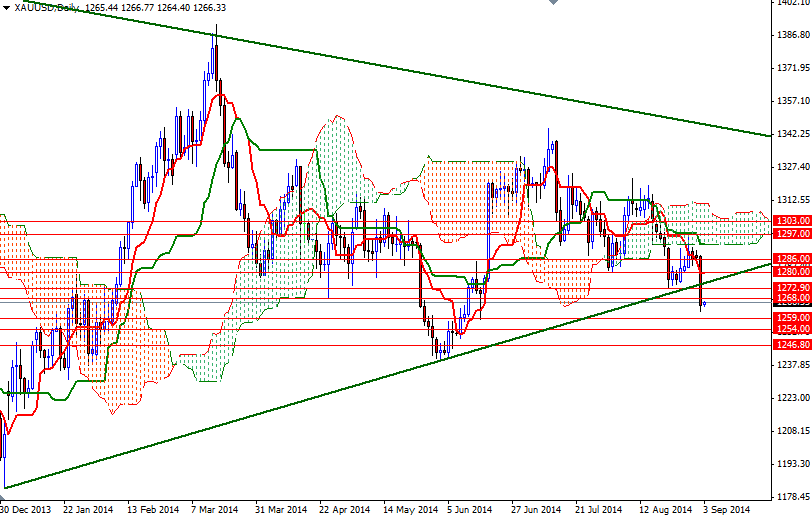

Yesterday's price movement brought the market below the Ichimoku cloud on the weekly chart. Now the XAU/USD pair is moving below the clouds on the weekly, daily and 4-hour time frames and we have bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses. In addition, the Chikou span (brown line), which resides under the daily cloud, also suggests lower prices will come. To the upside, the first hurdle gold needs to jump is located around the 1268 level. If the bulls manage to push and hold prices above this level, it could be technically possible to see the pair revisiting the 1274/2.90 area. Beyond that, expect to see more resistance at 1280. However, if the American dollar resumes its bullish sentiment and prices break yesterday's low, then the next stop will be 1259. The bears will have to drag price below 1259 in order to tackle the supports at 1254 and 1246.80.