The XAU/USD pair (Gold vs. the American dollar) settled higher yesterday, marking the first rise in four trading sessions, as caution set in ahead of high impact economic data releases and central bank policy meetings. Lately, fading geopolitical risks coupled with speculations that the Federal Reserve may have to raise interest rates sooner than expected have been keeping gold under pressure. It appears that market players are fixated on the American dollar's strength and because of that I think signs of improvements in the U.S. economy will draw more attention than usual.

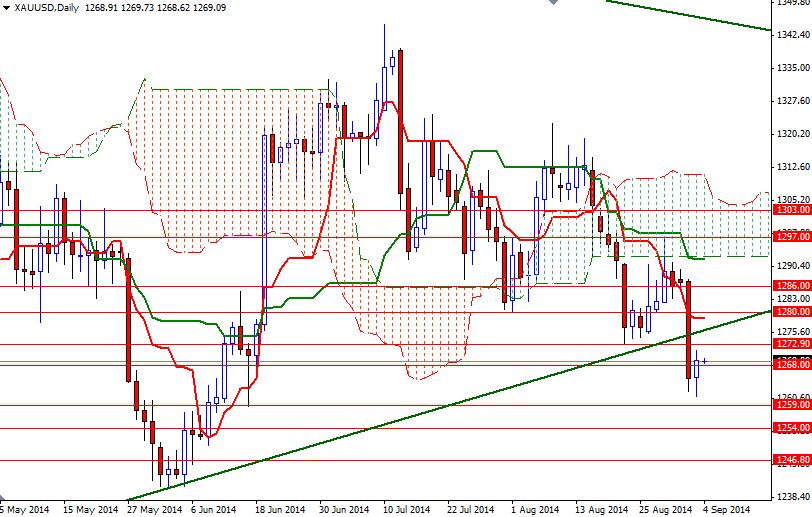

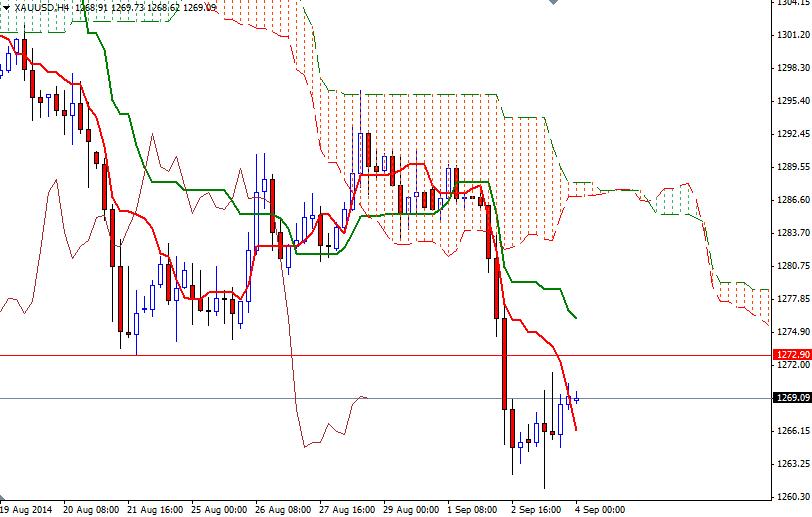

From a technical point of view, the weekly and daily charts will remain bearish while the pair trades below the Ichimoku cloud on the weekly and daily time frames. As a result, there will be significant resistance levels ahead and breaking through these barriers may not be so easy. The thickness of the Ichimoku cloud is important because the thicker the cloud, the less likely it is that prices will manage a sustained break through it. The thinner the Ichimoku cloud, a break through has a better chance.

However, in the near-term, I will be paying attention to the 1272.90/4 and 1259 levels. If the bulls manage to hold the pair above the 1268 level, we may see a bullish attempt towards 1272.90/4. The bulls will have to break through 1280 in order to gain enough momentum to start a journey to the 1286 resistance level. If the market encounter heavy resistance and prices start to fall, support can be found at 1268/6.22 and 1260/59. A daily close below 1259 would indicate that the pair will extend its losses and target the 1254 - 1246.80 support levels afterwards.