The XAU/USD pair closed lower than opening on Thursday as strength in the American dollar helped draw investors away from the precious metal. The pair traded as high as $1277 an ounce after he European Central Bank cut interest rates but encountered heavy resistance and reversed its course on better than expected PMI numbers. Data released from the Institute for Supply Management showed that its non-manufacturing index climbed to 59.6 from 58.7 a month earlier.

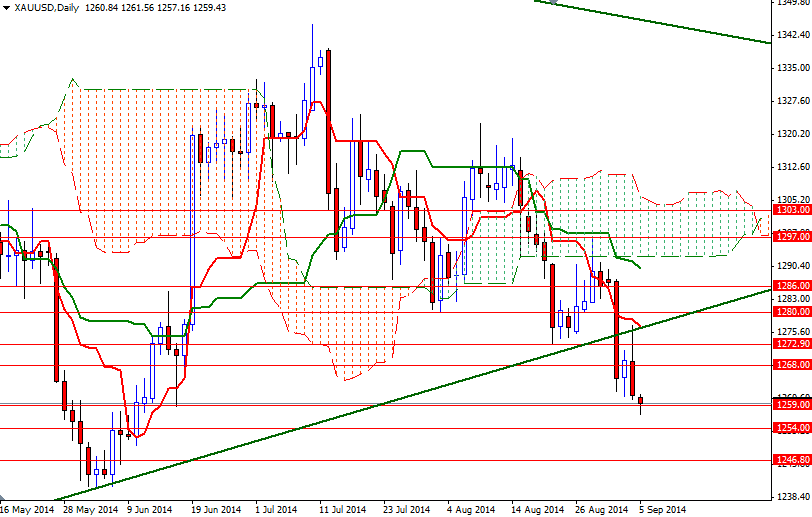

Today, during the Asian session, the XAU/USD pair fell to a twelve-week low of 1257.16 before recovering to 1259.43. Since gold prices found both support and resistance around the 1259 level in the past, it is not surprising to see some profit taking at the moment. Besides, investors might be hesitant to put larger bets ahead of today's non-farm payroll report.

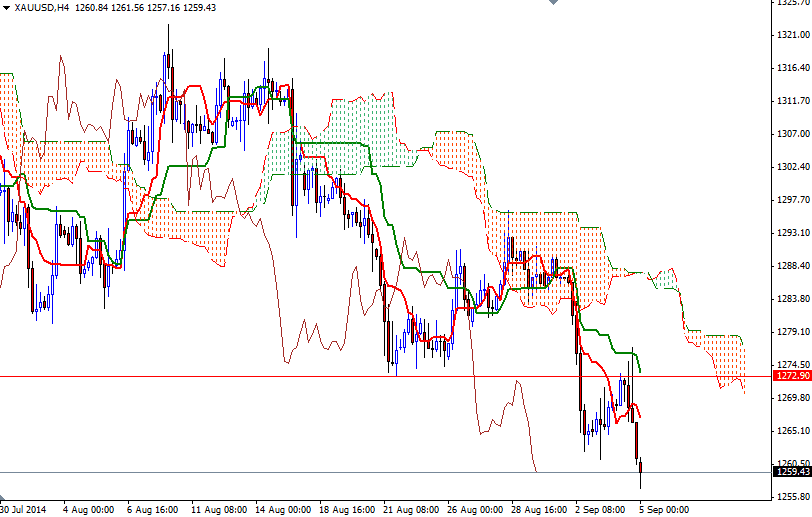

Since the market dropped below the Ichimoku clouds on the daily time frame, I have been telling that technical outlook was bearish and the bears had more strength than the bulls. I think yesterday's price movement support this theory. The XAU/USD pair tested the ascending trend-line -which was broken just a couple of days ago- as resistance and failed to break through. Because of that, until this negative technical outlook changes, signs of weakness are what I am looking for. From an intra-day perspective, I think the key levels to pay attention will be 1259 and 1266.60/1268 (close of a 4-hour bar is important). If the bulls can hold prices above 1259, they might have a chance to reach the 1266.60/1268 zone. Beyond that, resistance can be found at 1272.90/1274 and 1279/1280. The bears will need to pull the market back below the 1259 level if they intend to charge. In that case, 1254 and 1246.80 will be the next possible targets.