Despite Friday's gains, the XAU/USD pair declined 1.46% for the week and settled at $1268.82 an ounce. Without doubt, the main event of the last trading day of the week was the release of the U.S. jobs report. Data released by the Labor Department report showed that that the U.S. economy added only 142K jobs (below economists' expectations for an increase of 226K) and unemployment rate fell to 6.1%. Although the report was a bit concerning for people anticipating stronger growth, I don’t think it’s weak enough to alter the Fed’s projections/plans. Besides, one economic number doesn’t make a trend. Anyway, gold prices have been under pressure for the last couple of months so the bulls took advantage of an event which that brought down the expectations for higher Fed rates.

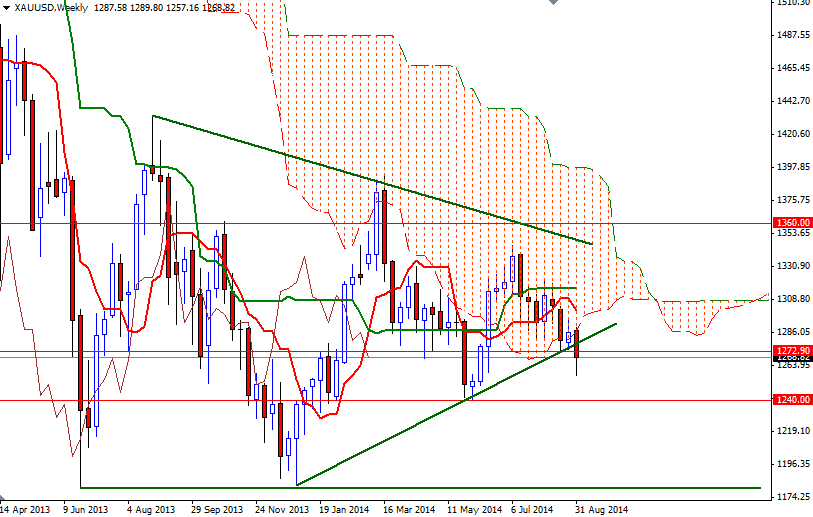

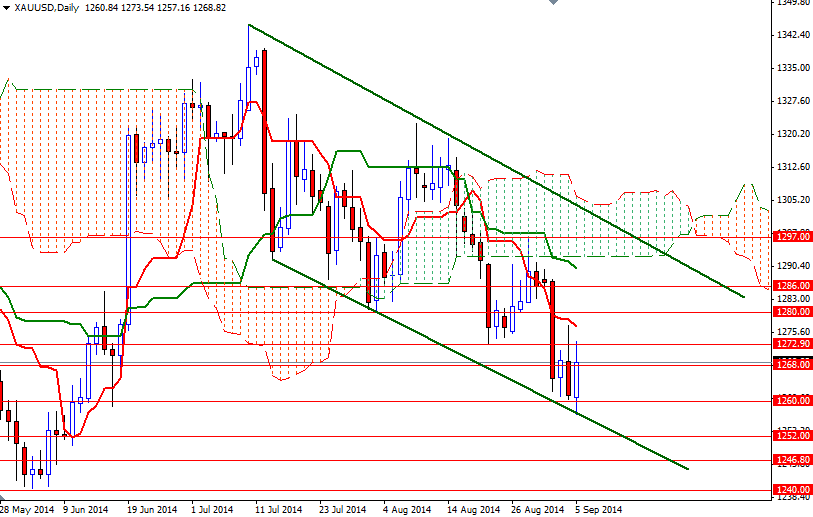

Meanwhile, Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions (for a third consecutive week) in gold to 96879 contracts, from 113169 a week earlier. The pattern on the charts suggests that the XAU/USD pair will resume its bearish sentiment as long as we continue to remain below the Ichimoku clouds. However, as you can see, the market has been moving inside a descending channel. Therefore, prices may continue to respect this channel and march towards the 1293 level where the bottom of the daily cloud and the top of the ascending channel converge.

To the up side, there will be hurdles in the way such as 1280 and 1286 but of course the bulls will have to clear the 1272.90/4 resistance area first. I think the 1260/52 zone is going to be crucial going forward because this area has been both resistive and supportive in the past. Breaking below this support, at least on a daily basis, would make me think that the bears will be aiming for 1246.80 (and then 1240) next. Since this week's economic calendar is light, the major equity markets and USD/JPY pair will be on my radar as well.