Despite Friday's bearish price action, gold prices ended the week slightly higher and settled at $1217.66 an ounce. The major focus of the last trading day of the week was encouraging economic data out of the world's biggest economy. The XAU/USD pair traded as low as 1212.25 after the American dollar got extra lift from upwardly revised U.S. gross domestic product data. A separate report released by the University of Michigan showed its consumer sentiment index rose to 84.6 from 82.5 in August.

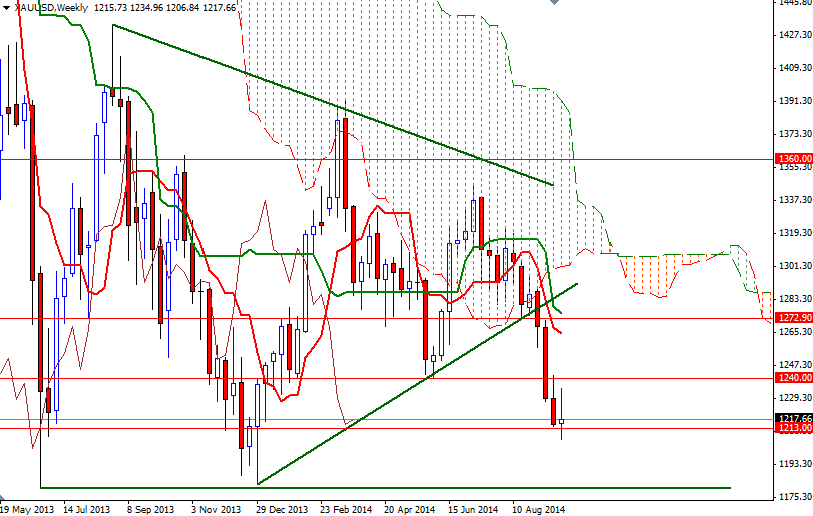

Although the American dollar is well bid today because of the U.S. data which corroborates expectations that the Federal Reserve will begin tightening monetary policy next year, the market has built up quite a big short since the 1292.70 level became a strong resistance. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions (for a sixth consecutive week) in gold to 63884 contracts, from 72187 a week earlier. That means the market will need some additional catalysts to attract further selling through key support at 1208. A successful break below 1200 may trigger a sell-off that can take us back to the 1280 level.

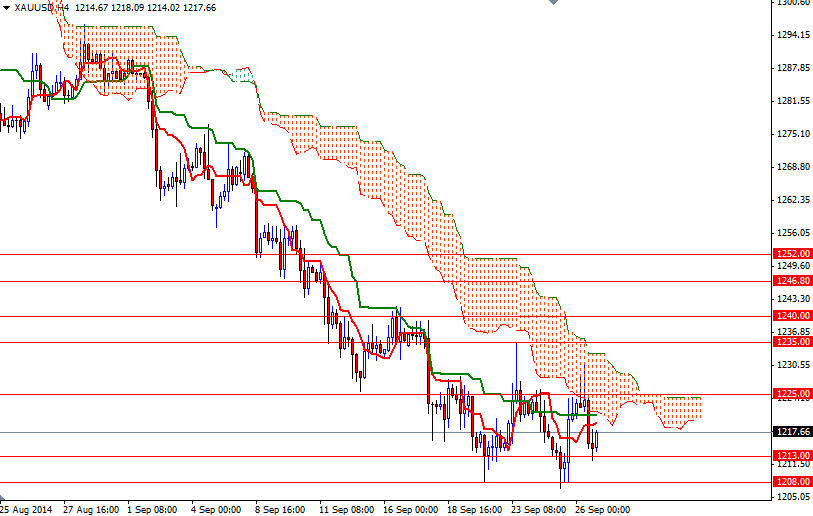

To the upside, the boundaries of the Ichimoku cloud on the 4-hour chart will continue to play an important role. In other words, the pair has to push its way through the 1225 - 1235 resistance zone in order to gain more momentum. Closing above the 1235 level would suggest that the bulls are targeting 1340. A heavy slate of key economic indicators will be released next week but of course the highlight of the week will come on Friday when the Labor Department releases its employment report for September.