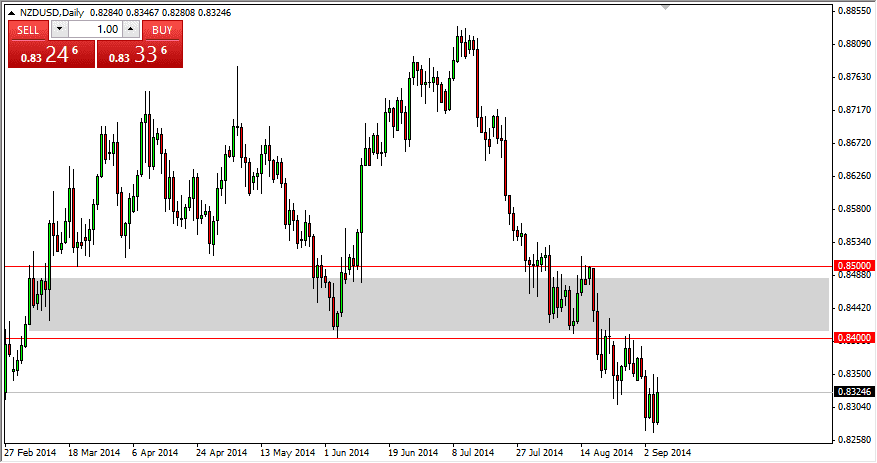

The NZD/USD pair had a positive Friday, as the Non-Farm Payroll numbers came out a bit light. However, this pair is in a serious downtrend, and I see quite a bit of resistance above. With that, I didn’t buy this market on Friday, and quite frankly am looking for a signal to sell the Kiwi again, as it certainly looks a bit vulnerable at this point in time.

The 0.84 level above is the beginning of serious resistance, and the resistance in my opinion runs all the way to the 0.85 level, so I feel that it will continue to be difficult to break above. With that, I am simply short or nothing in this market. Also, you have to keep in mind that commodity markets haven’t exactly been robust lately, and as a result it is probably going to work against the Kiwi dollar as it is so sensitive to the whims of commodity markets in general.

The trend is obvious – and I am not fighting it.

The trend in this market is obvious to me lately, especially as we broke down below the bottom of the consolidation area that we had been in. However, there is a bit of noise below, so falling isn’t going to be as easy at that. However, I think that rallies will be attempts to build up enough momentum to breakdown the support, and the US Dollar in general isn’t something I want to be short of at the moment. (One only has to look at what is happening to gold markets and the Euro in order to see why.)

The commodity markets aren’t showing signs of helping, and the Asian economic numbers haven’t exactly been stellar at this time either. In other words, it is hard to see New Zealand’s export market picking up in the short-term. This isn’t to say there won’t be rallies – but they are just selling opportunities as far as I can see. I think the USD is in a long-term bull market, and the Kiwi will suffer because of it.