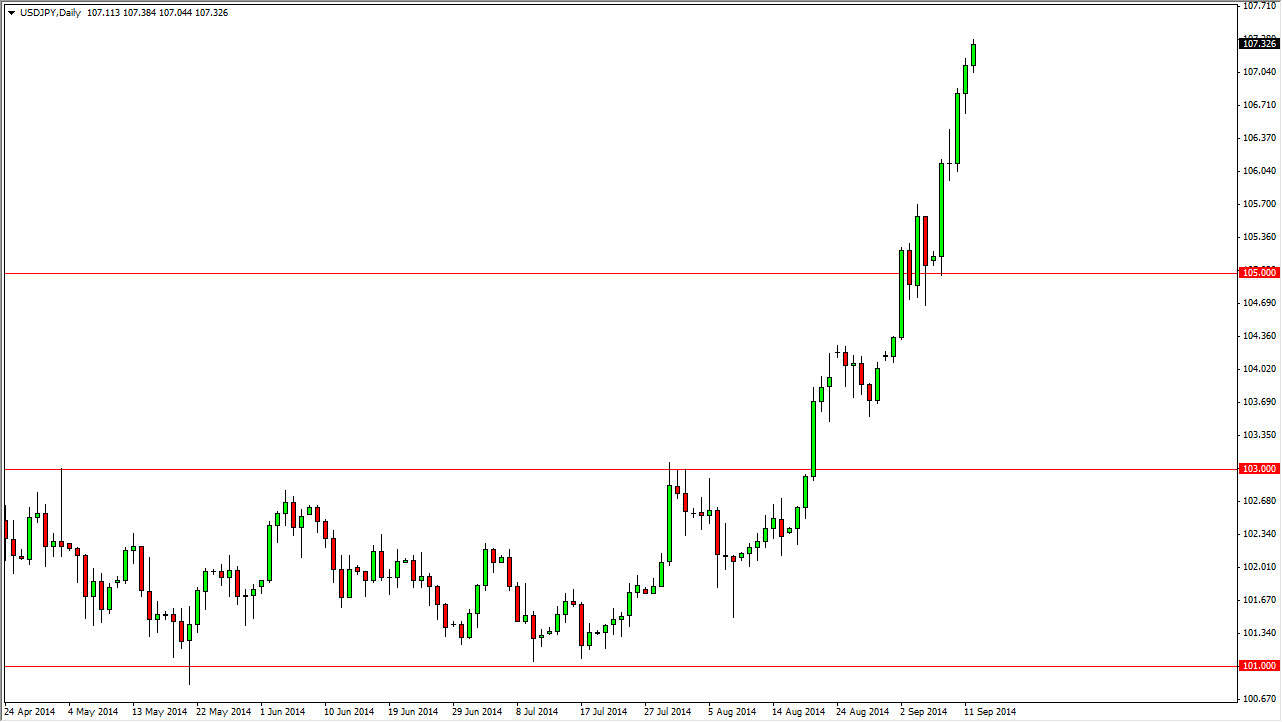

The USD/JPY pair rose again during the session on Friday, to continue the absolutely parabolic move that we have seen over the last several sessions. The biggest problem I have with this chart is in the fact that the trend is higher, this is something that I anticipated happening a long time ago. Rather than that, I’m concerned about how quickly we have gone higher. We need to see some type of pullback in order to find a relatively reasonable entry point into this marketplace. Right now, if you are not already long of this marketplace, it is very dangerous to start buying here.

The main reason I say that is that as you can see, we have had positive candles that we are starting to run out of links to those candles. That typically says to me that we are starting to run into a bit of exhaustion, but I do not see this as a selling opportunity, quite the opposite.

Letting the market come to me.

I’m going to let the market come to me. What I mean by this is simply let the market pullback and show signs of support between this area and the 105 area, which to me seems to be the “floor” in this marketplace. I don’t think that we will fall below there, and they do expect to see this market go all the way to the 110 level given enough time. I understand that it’s very difficult to watch a market like this in not be involved, but trust me on this - there will be a pullback and the trend should continue.

That being the case, look at the US dollar as the instrument that you are trying to buy. Understand that pullbacks will represent value in this case, and as a result the US dollar will essentially be “on sale” when the market falls back. Supportive candles will be reason enough for me to start going long, and I think that we are starting to see the beginning of a longer-term multi-year move.