USD/JPY Signal Update

Last Thursday’s signal expired without being triggered.

Today’s USD/JPY Signal

No signal is given today.

USD/JPY Analysis

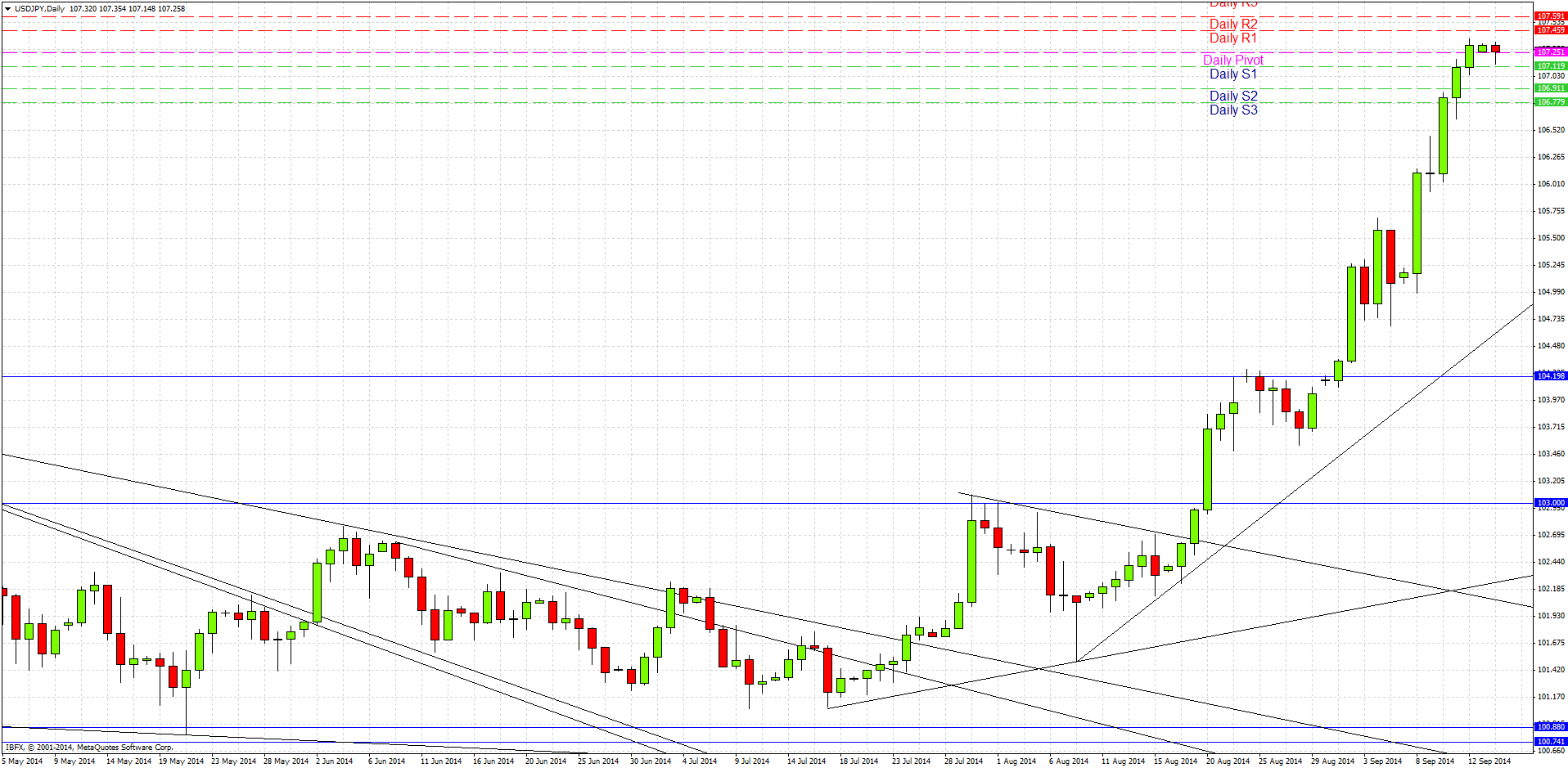

My last forecast was written on Thursday morning when the price was below 107.00. I wrote that the price was getting too high to buy and that I was waiting for a pull back before getting long. Since then the price made new highs on both Thursday and Friday and closed up on both of these days. Therefore what I wrote last Thursday morning is even truer now. It is problematic that there are no obvious broken resistance levels at which to look to buy anywhere near the current price.

Additionally, there are no obvious resistance levels above us where we might expect the price rise to slow down or turn before 110.00. Having said that, we did get to within almost 10 pips of 107.50 on Friday, which may be a natural psychological barrier from which the price might need to retrace to build up enough steam to make a successful breakthrough. Therefore I do expect the trend to slow and for the price to finally have a down day quite soon. I don’t really believe in the concept of “overbought” markets, but if there is such a thing, this is one. My colleague Christopher Lewis shares my outlook on this pair. He is waiting for a pull back to the 105.00 area which he sees as the natural “floor” of this market.

There are no high-impact events scheduled today concerning either the JPY or the USD. In fact, today is a public holiday in Japan. Therefore today should be a very quiet day for this pair.