Friday could have been a big day in this pair. After all, the US and Canada were both releasing employment numbers, and those are major factors in determining the value of a currency. The problem of course is that both of these countries disappointed with lighter than anticipated numbers. With this, there is a bit of confusion when it comes to where the pair should be valued, and that explains why it was relatively unchanged at the end of the day.

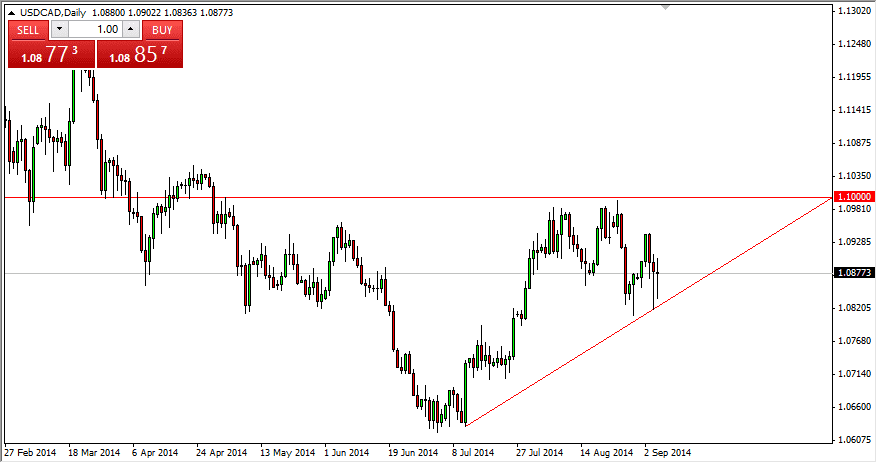

However, that isn’t to say that I can’t see some kind of value in the session. After all, the market tried to sell off, but couldn’t hold the losses. Also, Friday was the second day in a row that formed a hammer, which of course is very bullish. However, there is the problem with the 1.10 level above being so massively resistant to buying pressure.

Oil markets aren’t a help either, but then again – should they be?

The oil markets are traditionally what traders look to for guidance in this pair, but the dynamic of this market, and the oil market for that matter, is changing rapidly. After all, the US is producing more and more of its own oil, and this leads to less and less Canadian imports for the Americans. In other words, the oil markets aren’t as reliable as they once were for predicting the moves in this pair.

I feel that this market will eventually break out to the upside, but it is going to take some momentum building in the meantime. The 1.10 is a major barrier, but at the end of the day, I think that the overall desire to own the US dollar by market participants will win out. This is especially true after the Friday numbers, as the Canadians actually lost jobs – something the Americans are far from doing at this point. In that scenario, there is no real threat of a breakdown as far as I can see, but at the present time, I think looking to buy short-term pullback for small gains is probably the best strategy.