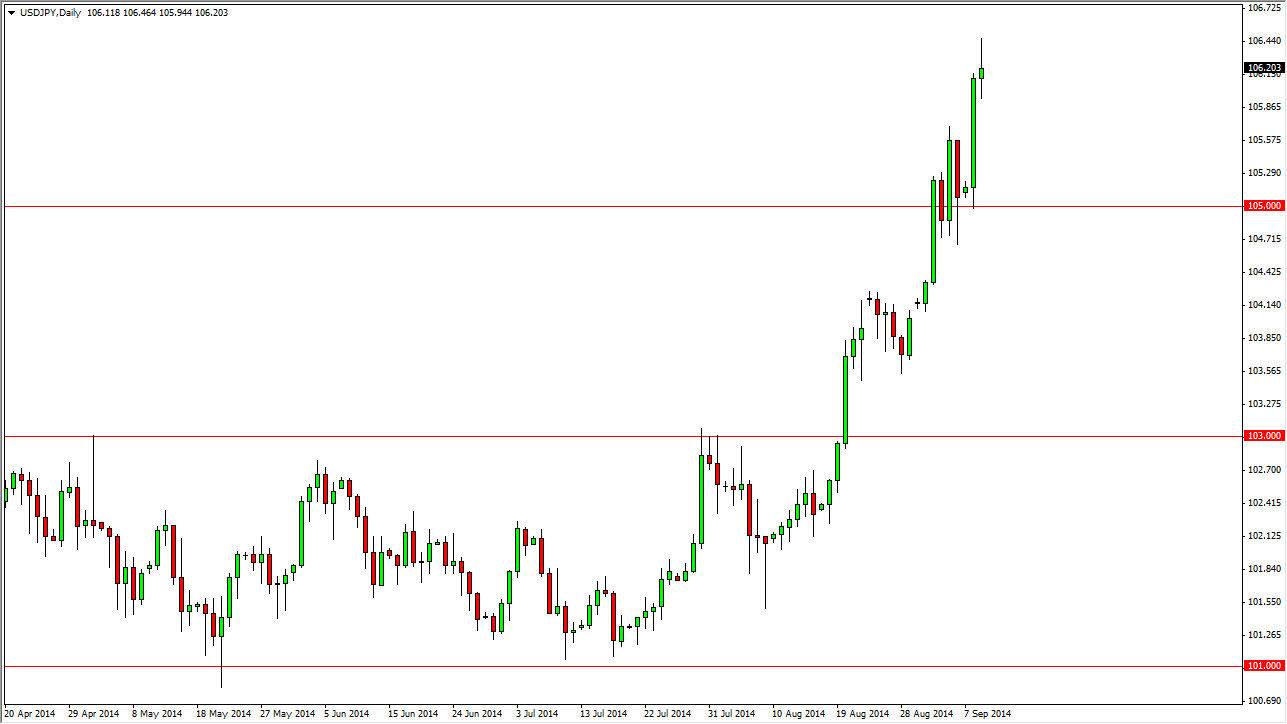

The USD/JPY pair initially surged higher during the session on Tuesday, but as you can see struggled once we got above the 106.25 region. With that being the case, we ended up forming a little bit of a shooting star, and that of course suggests that the market is going to see some weakness. However, I believe that there is a significant amount of support at the 105 region in order to warrant buying this pair on a pullback. I also think that the 105.50 level is an area that was recently resistance, and is essentially a “higher high.”

The top of the shooting star been broken is also a positive sign as well. The US dollar of course is going to be strong in general, as the Federal Reserve is anticipated to cut back on quantitative easing going forward. On the other side of this equation, you have the Japanese yen, which of course has the central bank looking to keep the monetary policy extraordinarily loose. With that being the case, the market is essentially a “one-way ride”, and as a result I am buying this pair every time it pulls back. With that, I believe that we are about to get one of those opportunities.

105 is the floor.

I believe that the 105 level is the floor in this market, and that the support extends 50 pips. Because of that, I am looking at roughly 105.504 a buying opportunity on short-term charts. We have broken out above significant resistance historically, and as a result I think that the market is then going to head to the 110 level. It’s only a matter time, and I think we will continue to see buying opportunities every time the market pulls back.

I don’t know how long is can it take to get to the 110 level, but I think given enough time we will get there. I believe that this is one of those situations where you can only buying this market, and selling this really isn’t a thought.