USD/JPY Signal Update

No signals were given yesterday.

Today’s USD/JPY Signal

Risk 0.75% of equity.

Entries only during London, New York and Tokyo sessions today (Tokyo Friday).

Long Trade

Long entry following a strong higher low after a major low once 105.92 is broken to the down side.

Plae a stop loss 1 pip below the local swing low.

Take off 75% of the position when profit is double risk and leave the remainder to run.

USD/JPY Analysis

There is not a lot more to be said right now than that this pair continues to be the hear of the Forex market, with the USD being the strongest and the JPY the weakest of all major currencies. We are continuing to make new multi-year highs in this strong bullish breakout that as yet shws no signs of stopping. The market is in exuberant, runaway bullish mode.

Money can be made in this environment by buying fairly blindly, but there is always the risk of sudden sharp corrections when the heavily bullish crowd gets nervous and wants to lock in a lot of the floating profit. For this reason, buying after a pull back turns around is safer, and that is why I am looking for a long under 105.92.

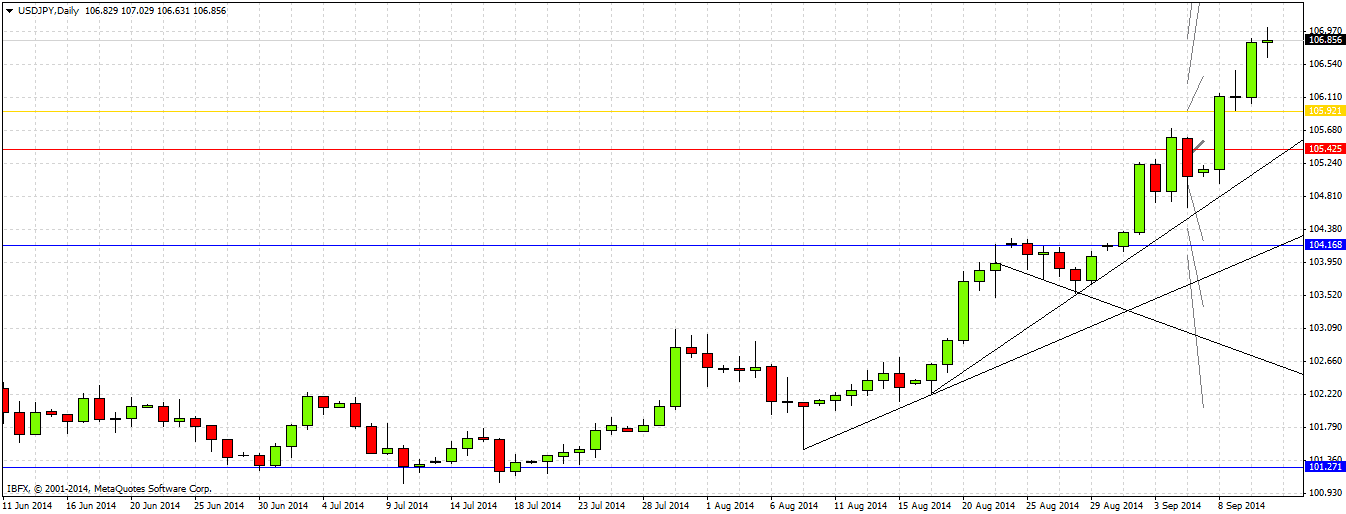

If that area does not hold, there should be further buyng opportunities at the key psychological round number at 105.00. There are also two bullish trend lines currently beneath that level, as shown in the daily chart below.

There are no high-impact events scheduled today concerning the JPY. Regarding the USD, at 1:30pm London time there will be a release of U.S. Unemployment Claims data. Today the New York session should be the most active trading period for this pair, but the market is in a runaway mood in any case, so anything can happen.