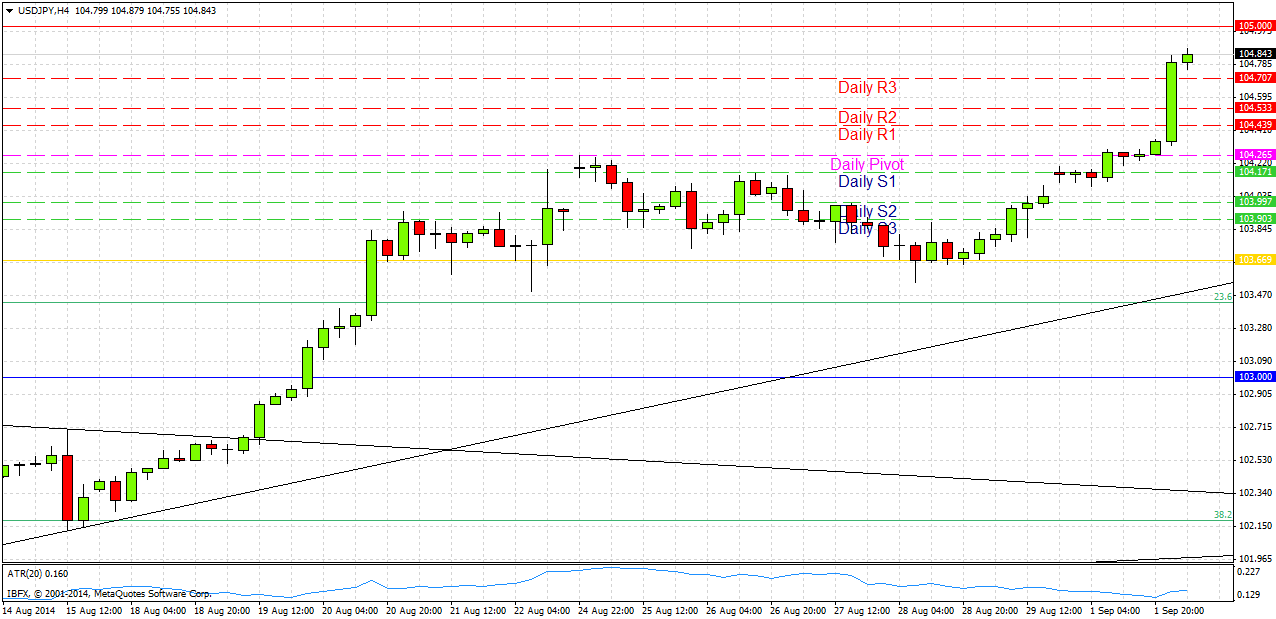

USD/JPY Signal Update

Yesterday’s signals expired without being triggered. If you have an open long trade from last week, a good level to take at least partial profit could be around 105.00 if we get there.

Today’s USD/JPY Signal

Entries may only be made before 5pm New York time or from 8am Tokyo time tomorrow (Wednesday).

Risk 0.75% of equity.

Short Trade 1

Go short following a very strong reversal following a first touch of 105.00.

Put a stop loss 1 pip above the local swing high.

Take off 75% of the position when profit is double risk and leave the remainder to run.

USD/JPY Analysis

The big story so far this week has really been one of weakness in the JPY. I have had a long bias on this pair and that continues strongly. Unfortunately we seem to be a long way away from any safe entry points right now, and additionally we are approaching a likely key resistant level at 105.00, which is why I do not have a long signal this morning.

Take great care in any short trades off 105.00. There still seems to be plenty of bullishness in this pair.

The level at 105.43 is the highest the price has been since 2008.

There are no high-impact data releases scheduled today concerning the EUR. Later at 3pm, there will a release of U.S.A. ISM Manufacturing PMI data. Therefore the New York session is likely to see the most activity in this pair over the next 24 hours.