By: DailyForex.com

USD/JPY Signal Update

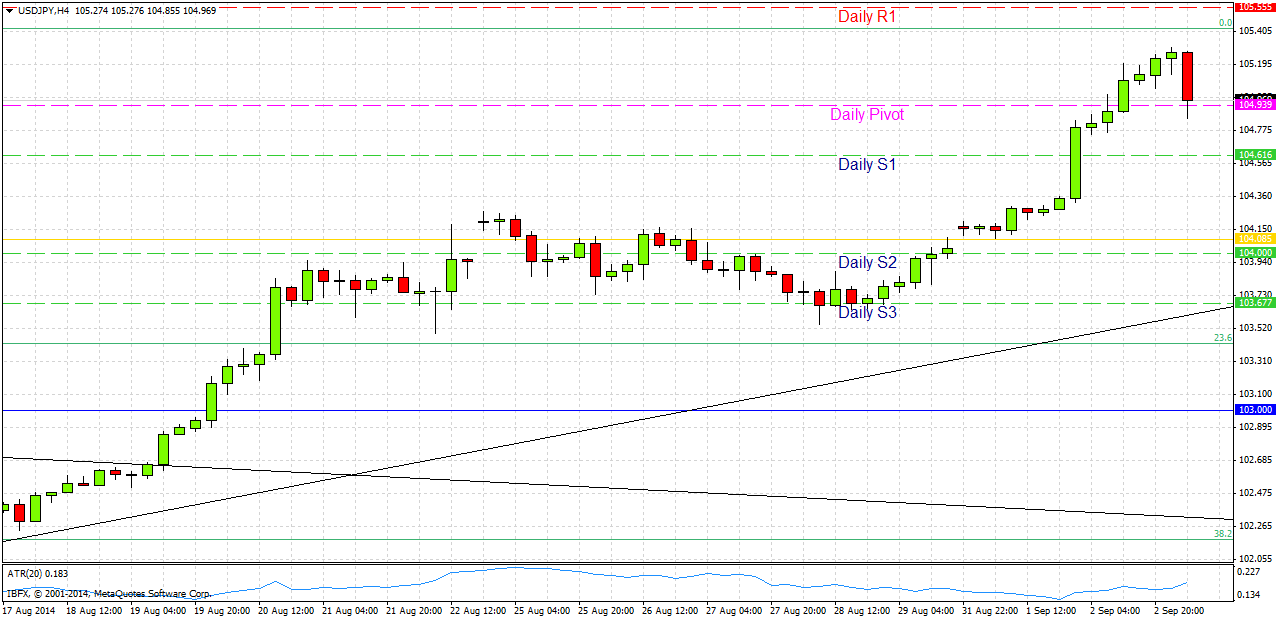

Yesterday’s signal was not triggered and expired. Although 105.00 was touched, there was not a strong reversal following this first touch.

Today’s USD/JPY Signal

Entries may only be made before 5pm New York time or from 8am Tokyo time tomorrow (Wednesday).

Risk 0.75% of equity.

Long Trade

Long entry following bullish price action on shorter time frames following the first entry into the zone from 104.18 to 104.08.

Place a stop loss 1 pip below the local swing low.

Take off 75% of the position when the profit is double risk and leave the remainder to ride.

USD/JPY Analysis

This pair has been very well positioned for long trades this week, as the USD has been the strongest, and the JPY the weakest, of all the non-exotic currencies.

Yesterday there was a very strong move up and we exceeded the key level of 105.00, and came within a few pips of the 6 year high at 105.43. Since then, the price has been falling this morning, more impulsively that it was rising, suggesting we are now going to get some kind of pull back.

I am not comfortable going short anywhere however, as there are no strong and obvious levels that look like they will hold.

In the very unlikely event that we get back to the area between last week’s open and this week’s open a little above the former resistance at 104.00, then this should be a great area to look for long trades.

There are no high-impact data releases scheduled today concerning either the USD or the JPY. Therefore it is likely to be a quiet day.