USD/JPY Signal Update

No signal was given yesterday.

Today’s USD/JPY Signal

Risk 0.75%

Enter before 5pm New York time or after 8am Tokyo time today only.

Long Trade

Go long following bullish price action on the H1 time frame following a first touch of 107.55.

Place a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the trade is 20 pips in profit.

Take off 25% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

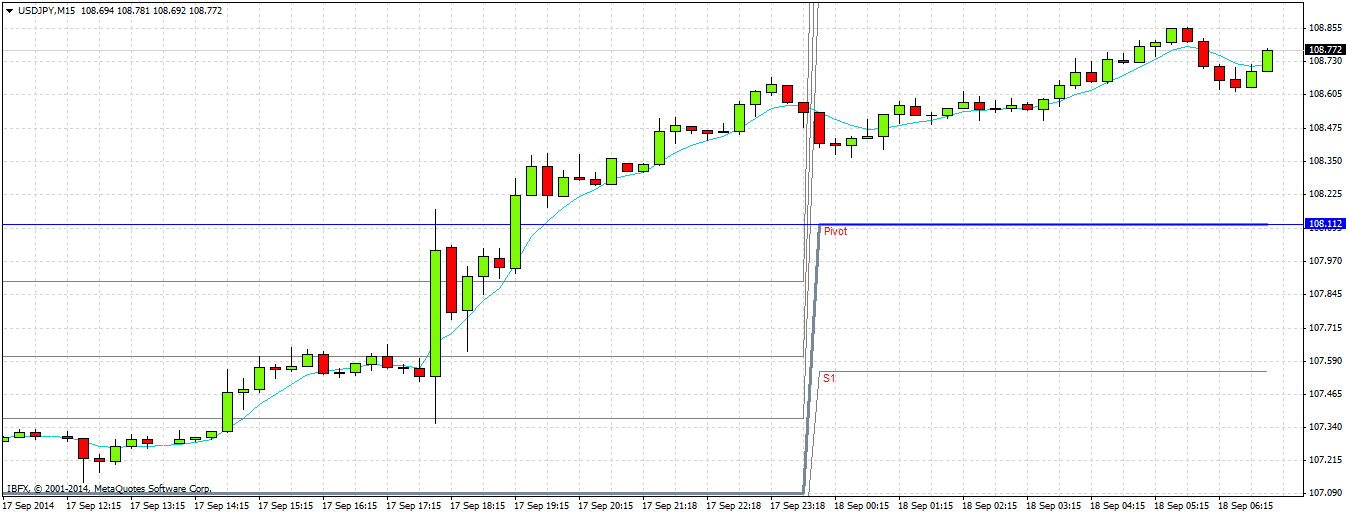

USD/JPY Analysis

This pair has been very strong, making new 6 year highs overnight following the FOMC data yesterday. The USD is slightly less strong against the JPY over the short term than the GBP, but the USD has certainly been the more consistent bet against the weak JPY.

One difficulty in taking advantage of all this bullishness has been finding good pull backs to likely support zones for relatively safe long entries. There are not really any obvious levels below us before the bullish trend line currently at around 106.15 and former resistance at 105.69. these prices are quite far away, so the best we can do for an entry today is probably to wait for a pull back to today's GMT daily pivot at 108.12, which is confluent with a swing high from yesterday.

There are no high-impact events scheduled today concerning the JPY, but there are regarding the USD. At 1:30pm London time there will be releases of US Building Permits and Unemplyment Claims data. At 1:45pm the Chair of the Fed will speak and then at 2:00pm there will be a release of the Philly Fed Manufacturing Index. This pair is likely to be most active during today's New York session.