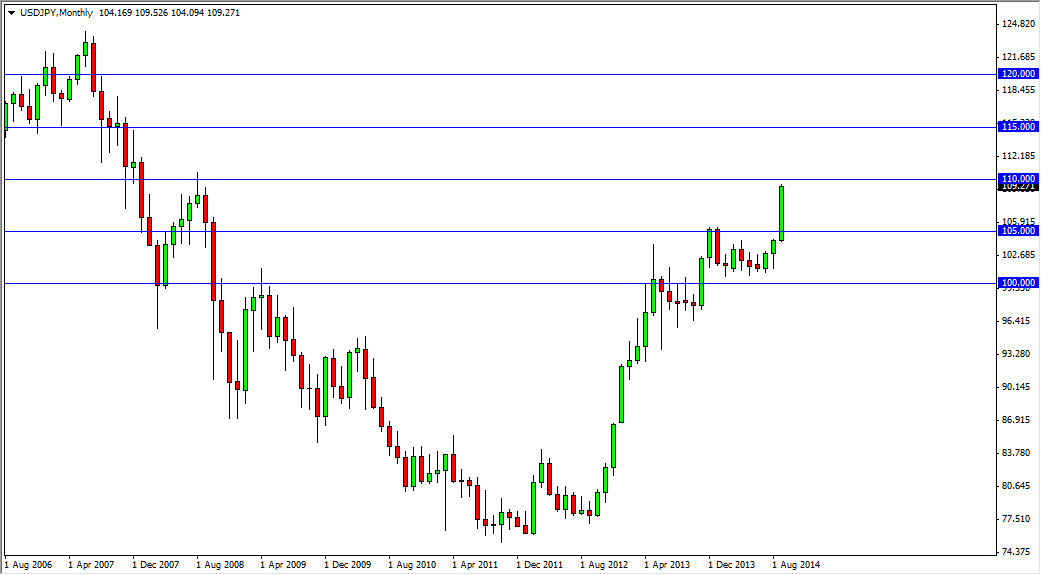

The USD/JPY pair looks as if it’s finally broken out significantly over the course of the last several weeks. However, the market breaking above the 105 level of course is a very positive sign but there’s still the matter of the 110 level. I think that’s early in the month we could see a little bit of a pullback as we are bit extended at this point, but nonetheless this is a market that can be only be bought at this point in time.

For me, the trigger price is the 110.50 level. If we can get above there, I believe that this market will break out to the 115 level. In fact, that is the base case scenario that I have. However, it comes down to whether or not we need to pull back first, which I think certainly won’t hurt anything at this point in time. A little bit of a pullback early in the month following buying significant strength is my plan. However, if we don’t break down our pullback from here, a daily close above the 110.50 level is enough for me to start buying.

Fundamental reasons.

I believe the fundamental reasons will continue to drive this pair higher, based upon the two central banks and the two economies are divergent as far as expectations. After all, the Bank of Japan will continue to keep the monetary policy loose, as they worry about exports. On the other hand, the United States is starting to tighten up monetary policy by cutting back on quantitative easing.

The Bank of Japan is on the opposite direction, loosening monetary policy as it goes along. I believe that the Japanese yen will continue to suffer because of it, which makes this a little bit of a “perfect storm”, as there are plenty of reasons to continue buying every time this market pulls back, and with that I believe that this market will offer nice long-term buying opportunity as well. In fact, I would not be surprised at all to see this market turned into the one that we used to see during the old “carry trade days.”