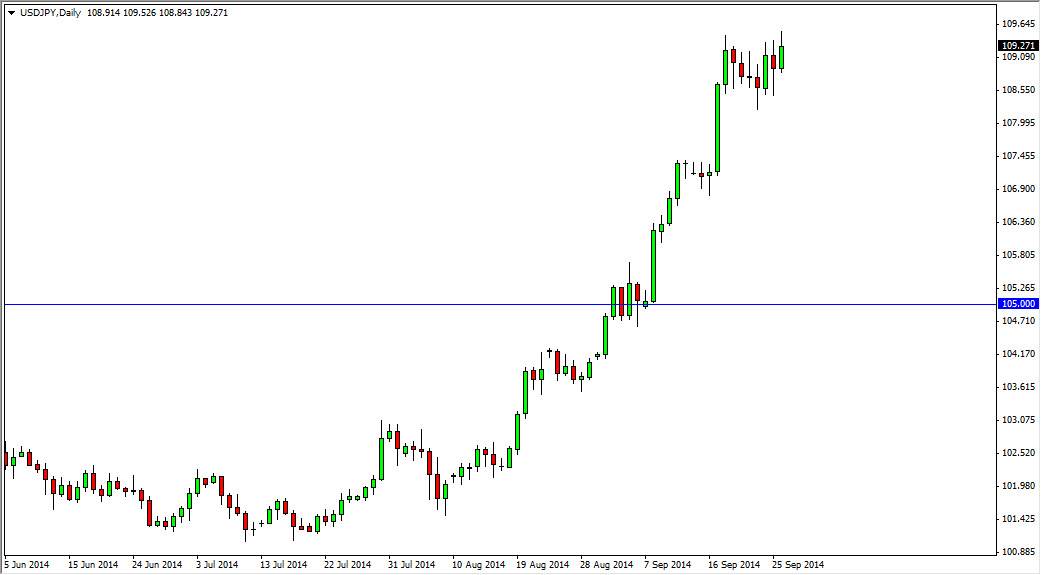

The USD/JPY pair rose during the course of the day on Friday, testing the 109.50 region. That being the case, it appears that the market is still trying to build up enough momentum to break out to the upside. Because of that, I think it’s only a matter of time before we get above the 110 level. However, getting above that 110 level is going to take a significant amount of momentum in order to do so, so it may take a little bit of time to make that move.

In the meantime, I think that a pullback from here is probably a reasonable expectation, at least for the short-term. The 108.50 level looks like it’s offering support now, but then again the 107 level is even more supportive from what I can tell based upon previous clustering. Because of that, I think that no matter what happens, you cannot sell this pair. After all, a parabolic move like this happens for a reason, and trying to fight that reason is difficult.

Central banks

One of the biggest drivers of this pair is going to be the fact that the two central banks are completely opposite as far as monetary policies are concerned. The Federal Reserve is tapering off of quantitative easing which is tantamount to tightening monetary policy. On the other side of the Pacific, the Bank of Japan is continuing a very loose in aggressive monetary policy in order to devalue the Yen.

With that, the pair should continue to go higher to matter what, but there will be times when we pullback. You simply cannot move in one direction forever and that’s what I’m counting on, some type of pullback. Those pullbacks will offer “value” when it comes to the US dollar, and as a result I will end up buying this pair every time it pulls back. Looking at this chart, I think that the 105 level will continue to be the “floor” in this marketplace and it is not until we get below there that I would consider selling.