EUR/USD

The EUR/USD pair sliced through the 1.28 support level during the course of the week, and also broke down below the 61.8 Fibonacci retracement level from the larger move. With that, I feel that this market is ready to continue going much lower, even though we are most certainly oversold at this point in time. I believe that rallies will continue to offer value, and as a result I will be selling this market every time it bounces. I believe that ultimately we go to the 1.25 level, and then probably much lower, possibly as low as 1.20 given enough time.

GBP/USD

The GBP/USD pair bounced during the course of the week, but turned back around in order to form a negative candle. The negative candle to me suggests that we are going to simply grind sideways in the short-term, but I think that the hammer from two weeks ago still suggests that we are going higher given enough time. I believe that the fact that that hammer showed up right at the 50% Fibonacci retracement, suggests that the “smart money” is starting to get back into the British pound. Because of this, I am bullish but I need to see some type of supportive candle or a break above the range of the week in order to start going long again.

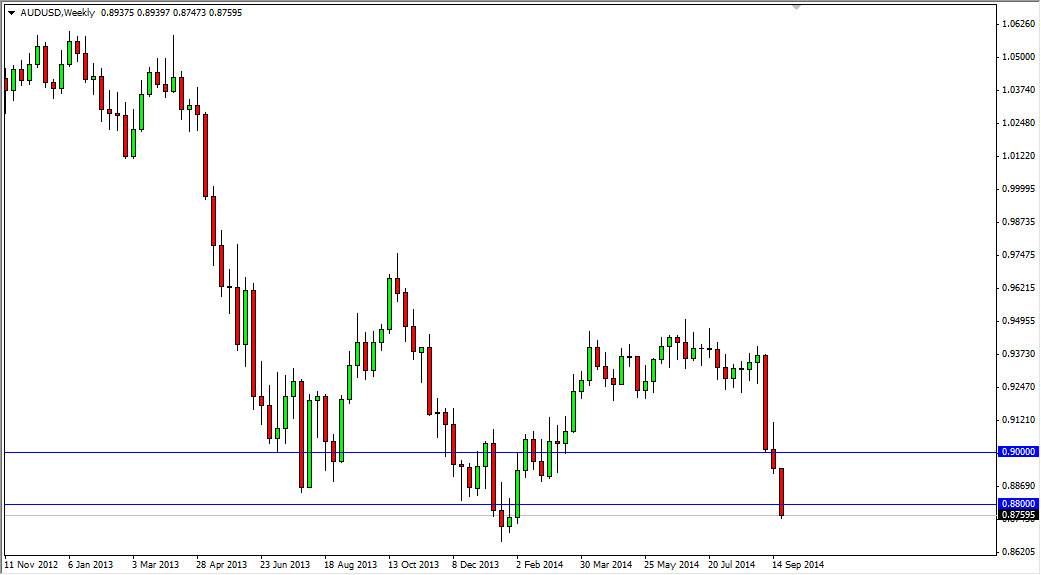

AUD/USD

The Aussie dollar fell again during the week, slashing through the 0.88 level without too many issues. The fact is that the market is reaching an extreme bottom at this point in time, so a bounce wouldn’t be that big of a surprise to me. However, I think that any bounce at this point time should be thought of as a selling opportunity. I believe that the gold markets will continue to be a bit of an anchor on the Australian dollar as well, so I have no interest in buying.

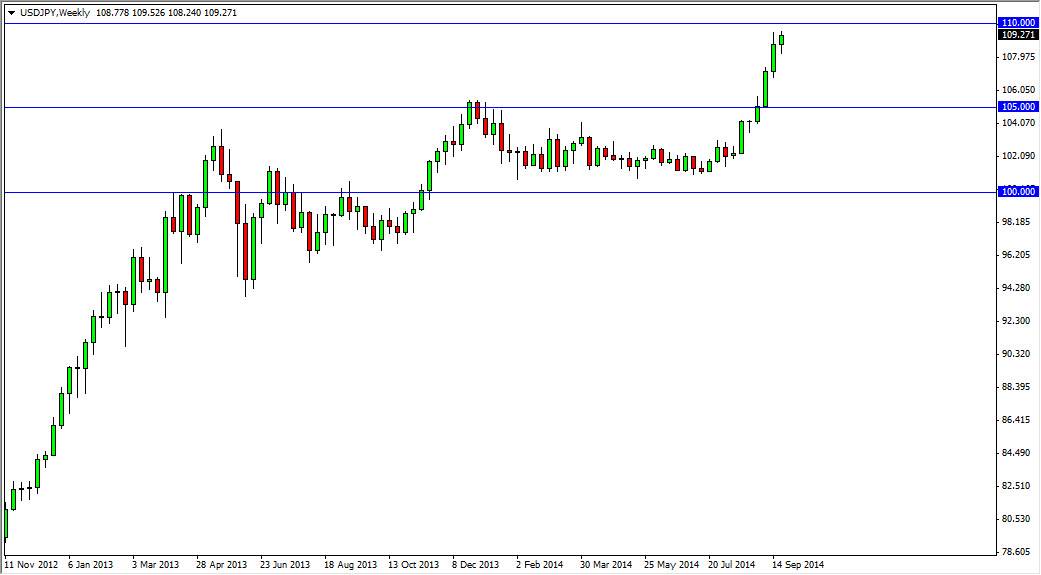

USD/JPY

The USD/JPY pair initially fell during the course of the week, but as you can see bounced enough to form a pretty significant looking hammer. The hammer of course sits just below the 1.10 level, which is an area of significant resistance as far as I can see. On top of that, the market looks as if it is a bit overextended at this point time, so that being the case the market should be one that you can buy on dips, and quite frankly that’s what I am waiting for some type of pullback in order to buy value as far as the US dollar is concerned.