By: Ben Myers

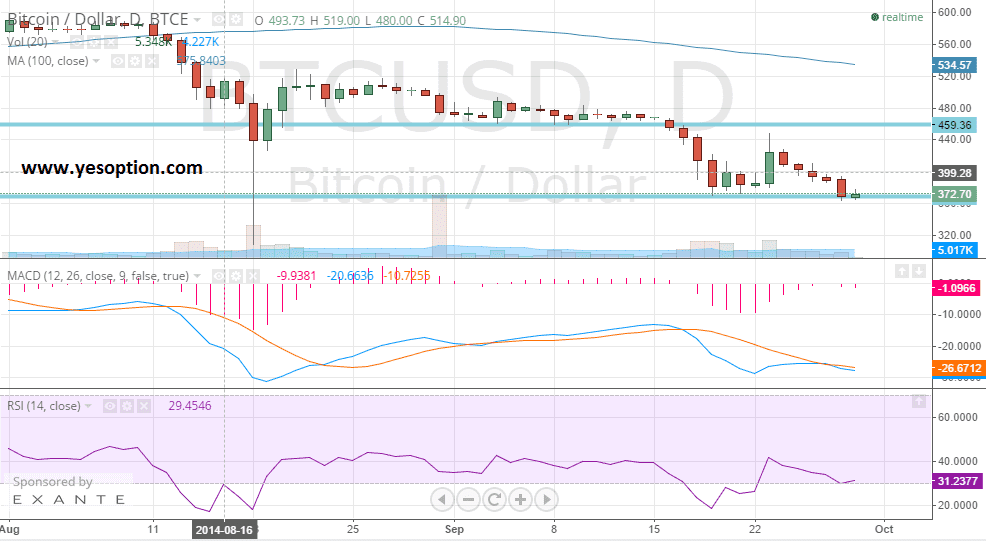

BTC/USD on the daily charts has been unable to build on its gains that it had seen a couple of days ago. It has re-entered into a downtrend and currently trades in a broad trading range with resistance on the upside at $459 and support at lower levels at $369. Traders believe only a move above or below the aforementioned levels would provide the next direction for the digital currency.

The BTC/USD continues to trade below all-important daily moving averages at the current moment. Traders continue to hold a bearish bias with regards to the near term view for the BTC/USD. The momentum indicators for the BTC/USD have given fresh sell signals and are showing no signs of a reversal at the current juncture. Similarly, the relative strength index is indicative of the strong bearish pressure present at the current moment.

One of the biggest surprises for the BTC/USD over the last week has been the news that online payment PayPal has joined hands with BitPay, Coinbase to accept payments through Bitcoin. It is being seen as a huge positive for the digital currency as more and more companies are incorporating Bitcoin as any other form of currency and not just as a financial asset.

Companies like Ebay and Dell have already started accepting Bitcoin as a form of payment. The top management at Paypal in a statement said that they believed that Bitcoin has a tremendous potential going forward which would allow seamless integration of technology with the traditional banking system. In other news, the FTC cracked down on Butterfly Labs was a huge negative, which traders are closely tracking going forward.

Actionable Insight:

Short BTC/USD at the current levels for a short-term target at $320, with a stop loss above $400

Long BTC/USD only if it closes above $400 with a short-term target at $440, with a stop loss below $387.