By: YesOption

Twitter Inc. (NYSE:TWTR) continued its downward trend during yesterday’s trading session due to above average volumes, which is a bearish indicator. Twitter and IBM recently announced a revolutionary partnership that will in essence redefine how companies and institutions understand their consumers. Twitter data and IBM’s analytics will combine and focus upon understanding social context on incredibly large scales.

Twitter announced that it would start training tens of thousands of IBM Global Business Services consultants regarding business applications for Twitter data, which will ultimately help companies understand their cliental in the best possible manner.

Twitter however, recently reported a dismal set of earnings, which clearly showed that its monthly average users fell far below expectations. The stock, after being corrected more than 10% during the past few trading sessions, is causing analysts to believe that it’s highly overvalued.

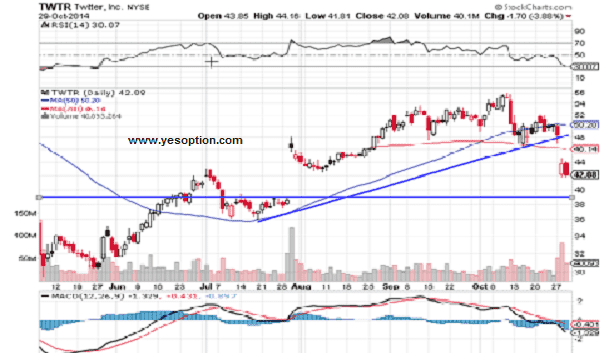

When looking at the daily chart for Twitter, the stock breached its support zone and additionally broke beneath its daily moving average, which is a bearish indicator. The stock has also tumbled below trend-line support, which analysts feel is a cause of concern for the company.

Twitter’s momentum indicator is giving a strong sell signal, indicative of the build-up of strong selling pressure at current levels. Furthermore, the relative strength index is indicating sell, signifying weakness. The next support level for Twitter comes at around $39.18 and the resistance is at approximately $46.14, which happens to be its 200-day moving average.

Actionable Insight:

Short Twitter Inc. (NYSE:TWTR) at current levels for an intermediate target at $39.18, with a strict stop-loss at $45

Long Twitter Inc. (NYSE:TWTR) only if it closes above $46.14 for an intermediate target at $50.20