By: YesOption

Amazon.com, Inc. (NASDAQ:AMZN) which has been in the news for all the wrong reasons as of late, was embroiled in even more controversy during the past couple of days. Noted economist and columnist Paul Krugman recently published an article accusing Amazon of being a monopolistic company, comparing it to Standard Oil. He believes that Amazon, through its sheer size was trying to arm-twist publishing houses like Hachette and behaving in what he believed was like a “robber-baron”. Marc Andreessen, the renowned tech investor who owns a stake in competitor EBay, came in defense of Amazon and stated that Paul Krugman is delusional and there is nothing wrong in Amazon’s adopted practices.

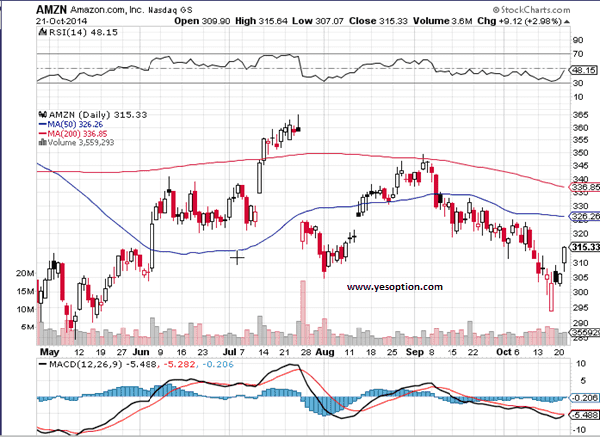

When looking at the daily chart for Amazon, its stock is still in the midst of a downwards trend, with its shares breaking below all-important daily moving averages, indicative of a strong selling pressure upon the stock. Although Amazon has additionally broken below its trend-line support, its momentum indicator on the other hand, is displaying its first signs of a reversal, thus indicating a buy signal, as interest is picking up at lower levels. Furthermore, the relative strength index has given a clear buy signal, which is a huge positive for the company going forward in the short-term.

Actionable Insight:

Long Amazon.com, Inc. (NASDAQ:AMZN) at current levels for a near term target at $326, with a strict stop loss below $294

Short Amazon.com, Inc. (NASDAQ:AMZN) if it moves below $294, for a short-term target at $281.