By: Ben Myers

BTC/USD had a very flat session yesterday after witnessing further selling pressure in early trading. Many traders and followers of Bitcoin are of the view that post the massive volatility seen in the last couple of days, weak hands from the market may well have been forced to exit and only strong hands are now in the market.

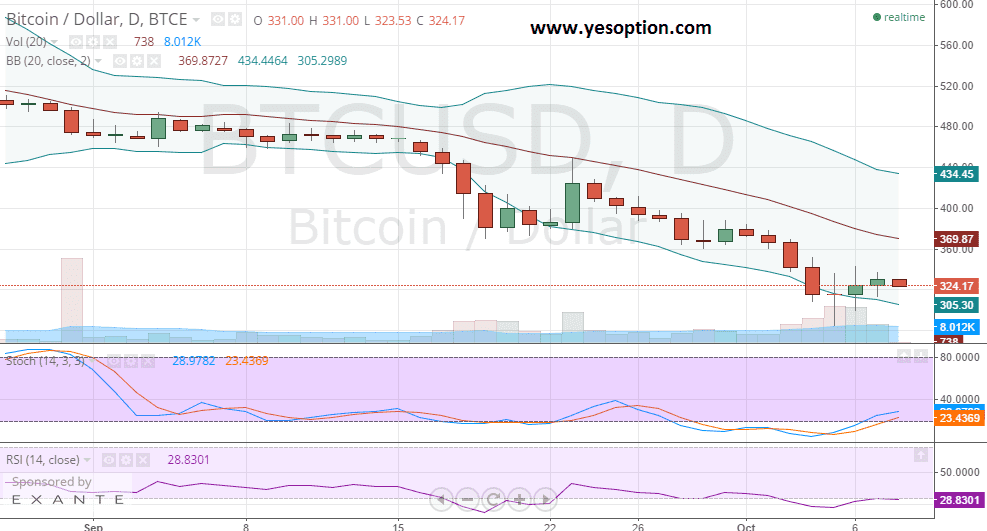

The BTC/USD continues to trend below all-important daily moving averages. The support for the digital currency continues to remain at the $300 level and on the upside, the resistance comes at around $342 levels. The stochastic oscillator for the BTC/USD has given a buy signal. The relative strength index too, is showing signs of a reversal, which is a huge positive for traders and investors.

Bitcoin wallet and analytics provider Blockchain raised close to $30 million in the first round of venture capital funding which is being considered as the biggest ever by a tech firm related with crypto-currency. This is indicative of the changing interest that Silicon Valley investors are now having towards Bitcoin and its future prospects. One thing, which will sooth bitcoin investors, would be the fact that there was contribution from Virgin Group Chairman Richard Branson as well.

The Bitcoin Foundation also announced that it would be taking measures towards standardisation of Bitcoin Symbol and Accounting code by early next year. In a statement released by the foundation it said that standardisation was an important step towards removing obstacles for mainstream adoption of the digital currency. It believes this is especially true in the case of financial innovation which has a global reach.

Actionable Insight:

Short BTC/USD if it breaks below $300 for a short term target at $240 with a stop loss above $321

Long BTC/USD if it breaks above $337 for a short term target at $375 with a stop loss below $319